A recent report from CoreLogic revealed that “piggybacked purchase loans” for FHA borrowers reach a new high in June of this year.

While piggybacked home purchases tend to be higher historically for those who take out FHA loans, they’ve surged in recent years.

The culprit is likely high home prices, which have made it increasingly difficult to come up with down payment funds, even if you only need 3.5%.

For reference, a piggyback loan is a second mortgage that is taken out concurrently with the first mortgage to extend the total amount of financing.

An example would be a first mortgage for 96.5% of the purchase price and a piggyback second for the remaining 3.5%.

While this is helpful for home buyers who have little set aside for down payment and closing costs, it could present problems if and when they attempt to refinance or sell.

FHA Piggyback Share Rises to 18% of Home Purchase Loans

From June 2022 to June 2024, the piggybacked FHA purchase loan share increased from 10.8% to 18%, per CoreLogic.

That’s nearly double the 9.8% share seen back in 2017 when the housing market was seemingly normal.

And while FHA loans tend to have a higher piggyback share in general, the recent increase is a whopping 67%.

It illustrates how stretched home buyers have become lately, especially those who need an FHA loan to qualify for the purchase.

FHA loans tend to go to lower-income home buyers and/or those with lower credit scores since you can qualify for a 3.5% down loan with as little as a 580 FICO score.

Meanwhile, you need a minimum 620 FICO to be eligible for a conforming loan backed by Fannie Mae or Freddie Mac.

CoreLogic notes that ongoing affordability issues have disproportionately impacted low-to-moderate income home buyers because these piggyback loans are more often seen on cheaper properties.

The median property value for homes purchased with a piggyback FHA loan was $34,600 cheaper ($168,600 versus $203,200) back in 2017.

This gap increased to $55,000 ($237,800 versus $292,800) in June 2022 and to $64,000 ($255,000 versus $319,000) by June 2024.

So arguably the most at-risk cohort of the population is the most overextended, at least in terms of loan-to-value ratio (LTV).

Many FHA Loans with Piggyback Seconds Are Already Underwater

Remember underwater mortgages? I haven’t written about them for what feels like a decade, but they’re starting to come back.

This all has to do with skyrocketing home prices and low or no down payments, combined with a recent softening in the housing market.

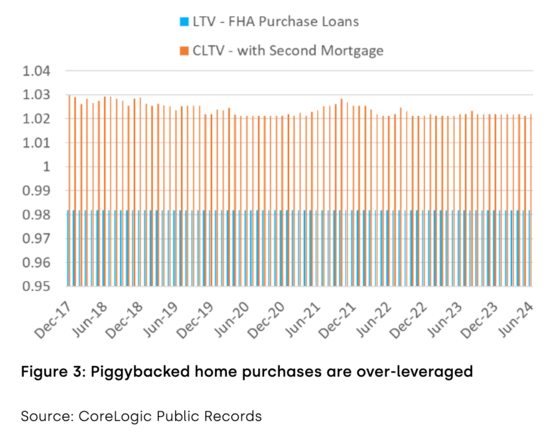

And the fact that right out of the gate, the median origination LTV for piggybacked FHA loans is 98.19%.

That’s before even considering the second mortgage, which puts the combined LTV, or CLTV, at 102.2%.

While it’s not a concern if the borrower can make their monthly mortgage payment, it becomes a problem when they can’t.

For example, if the economy takes a dive and/or the borrower loses their job, they’ve got zero skin in the game. And perhaps little reason to stick around…

This can be exacerbated if property values happen to fall as well. While home prices are still expected to rise marginally on the national level, individual markets across the country are now under pressure.

The more underwater the borrower is, the more likely they are to default. In addition, it could make it more difficult to qualify for a streamline refinance to take advantage of lower mortgage rates.

Technically, FHA borrowers are maxed at 125% LTV on streamline refis if they have a second mortgage. And even the presence of a second loan makes the process, well, less streamlined.

So the borrowers most in need of payment relief could be shut out if they’re holding a piggyback second mortgage that puts them in an underwater position. It would also be more difficult to sell the property.

While it has yet to be a problem, things could change quickly if the economy falls into recession and/or home prices begin to fall.