If you’re thinking about purchasing a property, you’ve likely sifted through available home loan options to determine what’s best.

There are lots of loan types of choose from, including conventional loans (those not backed by the government) and government-backed loans, such as FHA, USDA, and VA loans.

While each have their pros and cons, there is one hidden danger to taking out an FHA loan, especially if you’re buying a home as opposed to refinancing an existing loan.

In competitive markets where there are multiple bidders vying for the same property, the financing you choose matters.

Sellers want assurances that you can actually close your loan, and that could make or break your offer.

Home Sellers Care What Type of Mortgage You Use

Over the past decade, home buying has been very competitive. It’s been a seller’s market for as long as I can remember.

In fact, even when the housing market bottomed in 2012-2013, it was still difficult to find a property.

While short sales and foreclosures were prevalent then, inventory was still relatively scarce and many savvy buyers entered the fray quickly to scoop up bargains.

Over the years, it has only gotten worse, thanks in part to underbuilding since the mortgage crisis, and also due to record low mortgage rates.

That combination of limited inventory and low mortgage rates propelled home buyer demand to new heights.

And the fact that millions were entering the prime home buying age (of 34 years old) didn’t help either.

Long story short, you’ll often face other bidders when making an offer on a home. And one of the things sellers look at when evaluating offers is financing.

How will you be able to afford the property. Will you pay with cash? Probably not, but know that cash is king and will make your offer stand out above the rest.

A close second might be putting 20% down on the home purchase because it shows you’ve got a lot of skin in the game and assets in the bank.

It also provides wiggle-room should the appraisal come in low, allowing you to retool the loan amount as necessary.

Further down the pecking order are FHA loans, which allow borrowers to come in with just a 3.5% down payment and FICO score as low as 580.

While that’s great for borrowers in need of flexible underwriting guidelines, sellers might not be as keen. After all, they need the loan to fund to sell the property!

FHA Loans Have a Negative Stigma

That brings me to a new report from the Consumer Federation of America (CFA), which “highlights the stigmatization of FHA loans,” especially in competitive housing markets.

The graph above shows how FHA lending was popular when banks were risk-averse post-crisis, but fell off once conditions improved, possibly because such buyers were outbid by those using conventional financing.

In addition, they found that FHA lending is less common in more affluent communities or those that are predominantly white.

This means minority individuals may be relegated to less desirable neighborhoods, where seller’s agents are more familiar and willing to work with borrowers who need FHA loans to qualify.

The result is the unintended effect of “perpetuating socio-economic and racial segregation” in the housing market.

There are a couple main issues that drive this negative perception of FHA loans, per the CFA.

One is that the FHA includes a mandatory inspection as part of the appraisal process to establish minimum property requirements.

While it’s not necessarily an intensive inspection, it does require the property being financed by an FHA loan be “safe, sound, and secure.”

So things like access to clean drinking water and working appliances, and no hazards like lead-based paint or overhead power lines.

Some of these items might wind up being a nuisance for the seller, who must now either repair/resolve the issue or work out an arrangement with the buyer. The CFA notes that sellers aren’t “financially liable to make all repairs.”

But nonetheless, it can present an unnecessary roadblock and put a deal in jeopardy, especially if the buyer is already lacking funds.

That brings us to the second issue, which is that real estate agents have a “perceived stigma about FHA mortgages and their buyers.”

Some look at it like a loan program for less qualified applicants, or a government program (which it is) riddled with bureaucracy or inefficiencies.

In turn, it becomes a sort of self-fulfilling prophecy where such applicants might be avoided and then only bid on homes in less desirable areas.

These areas then see a high concentration of FHA loans as a result, and such loans become further stigmatized because agents in the “good areas” don’t deal with them.

If they are to make their way into a desirable neighborhood and/or home, they might find that they need to “overbid” to get their offer accepted.

What’s the Solution to Make FHA Loans Less Discriminatory?

The CFA came up with four policy recommendations to level the playing field for FHA loans, which they argue have helped millions purchase a home.

They believe more states and cities should pass “source of income” or “source of financing” anti-

discrimination statutes, which make it illegal to refuse to rent/sell/lease based on income used.

Originally intended to protect renters using things like subsidized Section 8 vouchers, it could apply to home buyers using government-insured mortgages.

For example, preventing anti-FHA language in an MLS listing or real estate advertisement.

The next step is to “simplify FHA inspection criteria” to reduce potential hurdles for home buyers.

Another measure would be for real estate agent trade groups to dispel myths related to FHA loans and educate them on how to better work with FHA buyers.

Lastly, they argue that Congress/HUD should increase funding for Fair Housing Centers to investigate FHA home buying trends.

And if necessary, bring cases against offending real estate agents, lenders, brokers, etc. that perpetuate “financing discrimination.”

While I’m not opposed to their findings or their solutions, the bottom line is sellers will still gravitate towards the most creditworthy buyers.

Their agents will likely reinforce this as well when looking at multiple offers. As noted, the cash buyer will always be king. Then the 20% down buyer, assuming they have at least decent credit.

Unfortunately, the lowest rung tends to be the FHA buyer, who can get approved with a 580 FICO score and 3.5% down.

Conversely, a conventional loan buyer using a loan backed by Fannie Mae or Freddie Mac needs a 620 FICO score. And there are fewer hoops to jump through in terms of a mandatory inspection being part of the appraisal.

So in practice, while FHA buyers shouldn’t be discriminated against, they will still be lowest in the pecking order when a seller evaluates offers, all else equal.

Perhaps some of the proposed solutions will help, but if sellers and their agents look at the loan like an underwriter would, and see a lower credit score combined with little money down, they might be less inclined to accept the offer.

And that’s not necessarily a bad approach or discriminatory. It’s weighing the options and determining which buyer has the best approval odds, which gets the home sold.

Make Yourself a Better Borrower Before You Apply for a Mortgage

While there are no doubt issues that need to be addressed and resolved in the lending space, there are some actionable things you can do on your own.

Often, FHA loans are used because the borrower doesn’t qualify for conventional financing.

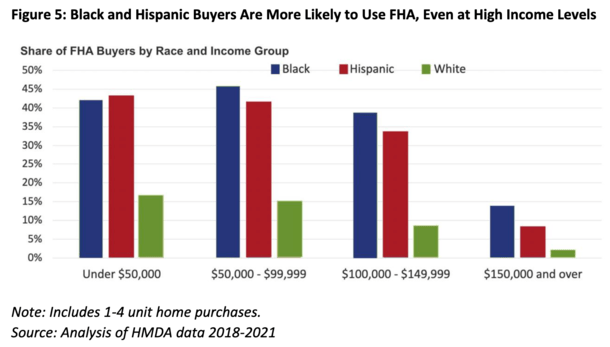

And sometimes this is due to a low credit score, as the chart above shows even high-income earners often wind up with FHA loans.

So something prospective home buyers can do is work on their credit before they apply for a home loan to ensure their three scores are all 620+.

At the same time, they can better educate themselves on their options so they’ll know if they’re eligible for a conforming loan before speaking to a lender.

Or they can outright ask the loan officer or mortgage broker if they qualify for a loan backed by Fannie Mae or Freddie Mac. And if not, why not?

If you get your ducks in a row early on, you’ll have more lending options at your disposal and be less impacted by any stigma attached to a given financing type.

You may even score a lower mortgage rate and get your offer accepted by the home seller in the process!

Read on: Conventional vs. FHA Pros and Cons