We all need sleep. As sleep culture and behaviours change, sleep products and services must see the light of the morning, and change too. This can help brands shift from the perception of necessity to welcome sleep as a vital part of lifestyles.

In recent years, the global sleep industry has experienced significant growth, expanding as consumers realise the vital role sleep plays in their health and wellbeing. Despite this rising positive awareness, many still can’t achieve sleep satisfaction. Brands can help bridge the gap from awareness of the benefits of quality sleep to actual quality sleep, enabling the sleep satisfaction that consumers crave.

Tap into the most critical sleep industry trends with this article.

Sleep Market Growth Indicators

Since the COVID-19 pandemic, consumers around the globe have reported increased stress, and have made lasting changes to their lifestyles as a result. Almost half of US consumers attribute worsening sleep quality to routine changes. Stressful global events, reduced physical activity and increased use of technology weigh heavily on our ability to get a quality night’s sleep. Such is the case in China.

Two years ago, Mintel reported that lifestyle routine changes were the second-most important factor impacting Chinese consumers’ sleep—it’s now the first.

This shift reflects a broader trend towards holistic health and wellbeing, where sleep is increasingly considered an integral part of overall health. Consumers are more aware of the impact sleep has on their lifestyles and the role that lifestyle plays in affecting sleep quality.

In response, the sleep-aiding health food and dietary supplement market in China has seen a 38.3% increase in online volume sales over the past year, overshadowing growth in the broader health food/dietary supplement category. In Germany, a quarter of consumers find sleep aids with benefits other than aiding sleep more appealing, with interest rising among Gen Z consumers. Notably, there is an awareness of the benefits of healthy digestion and quality rest, with almost half of German consumers agreeing there is a link between gut health and sleep.

These growth indicators signal an opportunity to drive interest in products and consumables that span across categories and functions, encouraging desirable sleep effects where they might not be expected. And brands aren’t daydreaming about this, they’re innovating. Traversing gaming and sleep, Pokémon Sleep is a mobile app that gamifies sleep by using the Pokémon universe to assist sleep tracking, offering rewards when quality sleep is achieved.

Source: pokemonsleep.net

Mintel’s GNPD tracked that between January and December 2023, new product developments (NPD) in Germany with botanical or herbal claims were in the sleep aid category more than any other individual category. German consumers are also using herbal sleep aids at a slightly higher rate than traditional sleep aids.

Australian beverage brand Arkadia has added botanicals like Ashwagandha to their “Calming Chai”, with additional functional ingredients like L-Theanine and pre/pro-biotics, to tap into demand for botanicals and products that cover more than one function.

This market diversification from mainly traditional OTC sleep aids towards products that promote overall sleep health is notable for brands in the sleep industry. Effective innovations like these generate interest and consumers respond with their wallets, creating a positive feedback loop that benefits both brands and consumers. Rising engagement with sleep behaviours is a key area too, and we’ll cover this in the next section.

Consumer Sleep Trends

Traditional perceptions around sleep are shifting. Routine disruption has caused consumers to pause, and consider how they sleep.

How are consumers sleeping?

Sleep satisfaction levels among consumers are enough to make any conscientious sleep brand toss and turn at night. Only half of consumers across regions are satisfied with their sleep. With low sleep satisfaction levels, consumers are more likely to welcome innovations that aim to enhance sleep quality.

Awareness of the domino effect of other lifestyle behaviours on sleep means that consumers seek personalised approaches tailored to their experience and expectations.

In China, consumers recognise the benefits of sleep-improving lifestyle habits, with almost three-quarters stating a bath or foot bath is “helpful” and “have done it” before bed. Japanese consumers also enjoy baths before bed but tend to differentiate between sleep-related habits and broader lifestyle factors that impact sleep. According to Mintel’s Japan Sleep Management Trends Report, the focus in Japan is more on integrating sleep improvement with broader health and wellness goals rather than sleep-specific changes.

Motivators to improve sleep

Traditionally, sleep advice has centred around the “7-9 hours” rule, suggesting that if you hit this mark you’re sleeping well. However, recent scientific research on the role of sleep on life quality sheds light on the fact that the quality of sleep—the ability to fall asleep quickly and stay asleep—has a bigger influence on overall life quality and wellbeing than sleep duration.

Fortunately, this supports where consumers are up to with sleep perceptions.

Globally, consumers value quality over quantity when it comes to sleep. In the US 88% of consumers agree that quality of sleep matters more than duration, and 64% of German consumers share this view. Similarly, while UK consumers agree that getting enough sleep is the most important health area of focus, fewer than a third say they have improved their sleep to manage their health.

The ingrained desire for quality rest is a strong motivator for consumers.

Both UK and Chinese consumers want to reduce screen time before bed, indicating a potentially global trend towards better sleep hygiene. This reflects the wider trend towards holistic health management, where consumers are making small lifestyle changes to improve sleep.

Beyond these lifestyle tweaks, consumers are motivated to improve sleep for the immediate health benefits. Increased energy, improved physical and mental health, and better mood are the strongest motivators for US consumers to seek better sleep.

As a result, Mintel is witnessing the growth of a “sleep health market”, Rather than just a sleep aid market. Consumers are looking to improve their lives, not just their sleep.

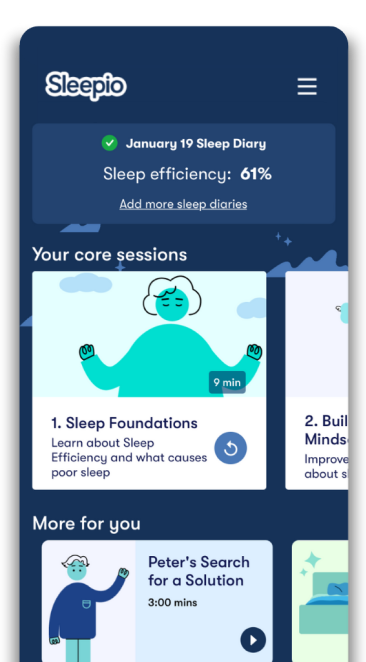

Brands can respond by focusing on enhancing sleep quality while considering wider lifestyle factors and choices. Functional food and drink, relaxation apps, and personalised insights from sleep tracking are areas to explore. For instance, the sleep tracking and improvement app Sleepio is now recommended by the UK’s National Institute for Health and Care Excellence (NICE), and offered by the UK’s National Health Service (NHS).

Source: sleepio.com

From Sleep Aids to Sleep Health

The sleep industry trends we’ve outlined so far indicate that consumers are leaning towards overall sleep health. However, this shift doesn’t mean that the over-the-counter (OTC) sleep aid market is hitting turbulence. In fact, half of US consumers report using them, opting for multifunctional pain relief and flu medications that include sleep support.

The German market has also shown consistent growth in recent years, with forecasts indicating growth of sedatives, sleep aids, and mood-enhancing OTC medication through to 2027.

Despite sleep aid market growth, there is still some scepticism about the effectiveness of sleep aids. Over half of Germans with sleeping issues do not use sleep aids. Leaning into multiple functions can spark interest from those who would otherwise be cautious. With consumers moving to a sense of overall sleep health, sleep aid brands will want to encompass a more holistic approach to sleep wellness.

The Impact of Sleep Tech

Interest in personal sleep quality is rising, driven by advancements in sleep technology and evolving health and wellness attitudes. In the US, over a third express interest in using a wearable device to monitor sleep quality, and a quarter of German consumers are willing to try it too.

This interest has driven new tech like AI sleep monitors that aim to enhance the sleep experience. On the high end of the market, US-based sleep tech firm Eight Sleep innovated a product that fits like a sheet onto the mattress and automatically regulates temperature based on measurable body responses like heart rate.

Source: eightsleep.com

Another innovation, the prescription-only device called NightWare, uses monitoring technology for those with sleep-related health conditions, to detect and disrupt users out of nightmares that would otherwise impact their wellbeing and sleep quality.

Innovations like these capture the attention of consumers, and with sleep being an unconscious activity, it’s no wonder that tech that continues to work while you sleep is not just appealing, but also incredibly functional.

What’s Next for the Global Sleep Industry?

Routine changes and a rising interest in personal sleep quality mean that consumers want brands to answer their sleep concerns.

Brands are already innovating solutions ranging from holistic functional food and drink to specialised bedding tech, and innovations on traditional OTC sleep aids.

But there’s room to appeal further. Consumers and brands are shifting towards the trend of overall sleep health, and you’ll want to move in the same direction to remain relevant.

The global sleep industry is an opportunity you don’t want to sleep on.

Explore Mintel’s health and wellbeing market research and subscribe to the Spotlight newsletter for exclusive insights into the latest trends.