Key Highlights:

- TV & Audio: Vizio has renewed an agreement with Comscore to provide ACR data, though the data’s availability after the Walmart-Vizio acquisition closes remains to be seen.

- Paid Social: TikTok officially rolls out Smart+ and GMV Max, and Meta announces new brand safety features, including disabling comments.

- Display & Programmatic: Creator and influencer content on YouTube is key to connecting with the Millennial and Gen Z audiences.

- Search: The DOJ released proposed remedies in Google’s antitrust case focused on restoring competition in search.

- Ad Economy: The attention metric debate – valuable insight or vanity metric?

- Consumer Economy: The inflation picture is mixed, the labor market is strong, and consumers are glum.

TV & Audio

In a somewhat surprising dynamic, news viewership has trended down in recent weeks, even as we are less than a month away from a presidential election that 84% of Americans believe will make at least “quite a bit of difference” in their lives. With both the vice presidential debate and the lone debate between former President Trump and Vice President Harris already out of the way, viewers’ attention seems to have begun to drift. Sports content has been a beneficiary, with NFL viewership coming in strong and a highly-competitive MLB playoff generating improved year-over-year ratings.

1. You may recall from our April 5th newsletter that Walmart’s acquisition of Vizio was particularly notable due to the control it gave the retailer over Vizio’s lucrative Inscape automatic content recognition (ACR) data. At the time, many – us included – wondered whether the deal would limit others’ ability to leverage this data, which Vizio licenses out to many players in the ad measurement industry, such as Nielsen and Comscore. Many of these recipients lean on ACR data to glean some insight into linear TV viewership and performance. For now, those concerns have abated a bit, as Comscore renewed its partnership with Inscape.

It remains to be seen what Walmart’s next steps here will be. The acquisition is not yet closed (Walmart previously indicated it would be complete before the end of January 2025) but the FTC is still conducting an antitrust review. For now, measurement businesses that rely on Vizio’s ACR data can breathe a sigh of short-term relief, though we will soon know whether this renewal with Comscore truly represents the combined entity’s path forward. Despite the market’s concerns, Tinuiti clients are largely insulated from these dynamics, as our patented linear attribution approach does not extrapolate based on a limited ACR-enabled subset of viewers but instead models across the full linear footprint. | AdWeek

2. Amazon continues to press its advantages in the streaming TV space. The digital behemoth is reportedly going to increase the ad load on Prime Video next year as it seeks to grow the $1.8B it generated during September’s upfronts by increasing the relatively light 2-3.5 minute per hour ad load it currently runs. In another move aimed at increasing subscriber counts, Amazon announced that it would offer Apple TV+ as an add-on subscription to Prime Video. And in a sign of its global ambitions, Amazon also acquired MX Player, a free streaming service based in India that, when combined with Amazon miniTV, supports over 250 million unique users.

While Prime Video is still substantially behind Netflix in terms of viewing time, it has trended up over the past six months, while Netflix has been stagnant. With Thursday Night Football helping support, Amazon is likely to creep closer as the year comes to an end. For advertisers, the increase in both viewership and ad load spells an enticing and easily-available opportunity for premium CTV investment. | Nielsen

Paid Social

1. Just in time for the holiday season, last week TikTok rolled out two key automated ad solutions to streamline campaigns and drive results. The first, Smart+, is an all-in-one automated tool that handles targeting, bidding, and creative — powered by AI — making it easier to quickly activate and scale on the platform. Very similar to Google’s PMAX, Meta’s ASC, and Pinterest’s recent Performance+ product, TikTok’s Smart+ allows users to automate everything from web to lead generation campaigns, placing a heavier reliance on the platform’s algorithm to achieve desired outcomes.

Ray-Ban was one of the earlier advertisers to test Smart+, and reported seeing a 50% reduction in CPA, as well as a 47% increase in conversion rates and a 42% improvement in ROAS by using Smart+.

TikTok didn’t stop there with product announcements. For merchants on TikTok Shop, the new GMV Max tool is a game-changer. It takes the heavy lifting out of campaign management by optimizing across organic content, paid ads, and even affiliate posts. Initial tests showed a whopping 30% increase in gross merchandise value (GMV). Especially for seller planning for the upcoming holiday sales season, these efficiencies are primed to be a really powerful addition to the media mix for any sellers leaning into TikTok Shop.

These updates are more than just incremental improvements — they’re a strategic move by TikTok to dominate e-commerce and ad performance during the holidays. By cutting campaign setup times in half and automating decision-making, TikTok is making it easier for both advertisers and merchants to hit their goals, delivering results in the most efficient manner possible. As TikTok continues to position itself as a key performance platform, expect more of a focus on performance products and measurement solutions heading into 2025. | TikTok, SocialMediaToday

2. Meta is introducing new tools to enhance brand safety and ad placement controls on Facebook and Instagram, providing advertisers with more flexibility over where and how their ads are shown. A key update allows brands to disable comments on ads before they go live, a feature being tested with select businesses. This is particularly useful because current limitations require advertisers to publish ads before manually disabling comments on each one.

The ability to turn off comments before media goes live will be instrumental for brands who often fall victim to internet trolls or operate in sensitive categories. While this toggle will appear natively within the ad-building process, Meta best practices still indicate that leaving comments active is optimal for favorability in the algorithm, although there are business-specific or case-by-case reasons where this new brand safety feature will be a positive change.

In addition to forthcoming comment controls, Meta is also expanding its collaboration with third-party partners like Integral Ad Science (IAS) to provide additional block lists, helping businesses avoid categories of content that may not align with their values. This update is part of a broader effort to boost brand safety and suitability on the platform, with early tests showing that pairing Meta’s internal filters with third-party lists can improve ad performance. Together, these upgraded brand safety tools should provide greater confidence and control over campaigns, ensuring they reach the right audiences in a brand-safe environment. | Meta, SocialMedia Today

Display & Programmatic

Last week, eMarketer strategically released two reports: one on the digital habits of each U.S. generation and the other on the expanding Influencer Marketing industry. It is essential to look at these two reports together because of how and where the millennial and Gen Z audiences are digitally engaged. While platforms like Facebook, Instagram, and TikTok have established their presence among Millennials and Gen Z, YouTube emerges as the frontrunner for both generations, capturing 89% of the Gen Z audience and 82% of the Millennial audience.

Understanding where the audience is engaged is crucial because, as eMarketer notes, 50% of U.S. social shoppers make purchases influenced by creator or influencer content. This is particularly pronounced among Gen Z and Millennials, who often turn to creators for inspiration and recommendations.

While the beauty and fashion category leads the charge in influencer-inspired purchases, creators also inspire action across various product categories, from food and beverage to auto parts, showcasing their broad appeal. Although the influence is less significant in some categories, we expect to see the impact of creators grow across categories as more consumers broaden their research across platforms.

A strategic, always-on creator program is the cornerstone of long-term growth, particularly for engaging with the younger generation. The key to capitalizing on this trend is aligning with engaging creators who fit your brand and are ultimately trustworthy. Advertisers also want to ensure they integrate their partnerships with a well-rounded video program.

This is even more important in the YouTube universe. If you have been in a YouTube meeting with me, you have likely seen the YouTube creative foundation slide showcasing the need for a mix of brand/product-focused ads alongside user-generated content (UGC)/creator content. Leveraging both in a YouTube campaign with different orientations and durations enables brands to engage consumers effectively, delivering the right creative based on their current stage in the journey. | eMarketer, eMarketer

Search

Back in August, the US District Court found Google liable for acting as a monopolist in general search services and search text advertising. Since then, DOJ attorneys have been drafting proposed remedies, which were released in a 32-page document filed on October 8. The remedies aim to restore competition in general search services and search text advertising by breaking down Google’s control over key market areas while preventing future monopolistic practices.

There were four “categories of harm” outlined in the latest court document, all of which were rebutted in Google’s response, which claims the DOJ proposals would “risk hurting consumers, businesses, and developers.” Those “categories of harm” include:

- Search Distribution and Revenue Sharing: the DOJ suggests Google’s control over search distribution must be reduced. Notably, the filing mentions, “Fully remedying these harms requires not only ending Google’s control of distribution today, but also ensuring Google cannot control the distribution of tomorrow.” Remedies may include limiting or prohibiting default agreements and revenue-sharing arrangements that stifle competition, and could also ensure Google’s products (ex: Chrome, Play, and Android) do not give an unfair advantage to Google Search over rivals. In Google’s response to the DOJ’s outline, Google warned that “splitting off Chrome or Android would break them” and “raise the cost of devices.”

- Accumulation and Use of Data: the DOJ claims Google’s massive accumulation of data gives it a significant advantage over competitors. Suggested remedies could include forcing Google to share wide swaths of information with rivals (including indexes, data, feeds, and models used for general and AI-powered search, as well as features and underlying ranking signals, “especially on mobile”), either “in whole” or through APIs. This would theoretically help level the playing field for competitors. But the filing calls attention to potential user privacy concerns re: data sharing associated with this set of proposed remedies. This stands out as a seemingly understated challenge that would likely present major issues when it comes to implementation and enforcement. In its response, Google highlights how being forced to share search queries and results risks user privacy and security, stating “The search queries you share with Google are often sensitive and personal and are protected by Google’s strict security standards; in the hands of a different company without strong security practices, bad actors could access them to identify you and your search history.”

- Generation and Display of Search Results: Google’s dominance in displaying search results, particularly with AI-generated features, is seen as a threat to competition. The filing states, “‘These results and features often rely on websites and other content created by third parties, who have little-to-no bargaining power against Google’s monopoly and who cannot risk retaliation or exclusion from Google.” Remedies could include limiting Google’s ability to control access to web content and preventing its AI-based products from leveraging content without consent from third-party websites. If enforced, this would be a major barrier that would require entire shifts in how brands (and publisher websites) opt in to certain sharing practices within the Organic search ecosystem. It could also “risk holding back American innovation at a critical moment,” according to Google, whose response cautioned about “enormous risks to the government putting its thumb on the scale of this vital [AI] industry.”

- Advertising Scale and Monetization: Google’s control over search text advertising undermines competitors’ ability to monetize their services. That level of control also “enabled Google to profitably charge supracompetitive prices for text ads while degrading the quality of those ads and the related services and reporting,” according to the DOJ filing. Remedies would aim to create more competition and lower barriers to entry, as well as increase transparency from Google search ad reporting while providing more flexibility to opt-out of certain search features. It could also potentially require Google to license its advertising technology to rivals. We will be paying close attention to more details on how this licensing would play out, with an eye on how they would account for factors such as intellectual property considerations.

Ultimately, we’re still a ways away from understanding the true outcomes and implications of this lawsuit. There is another “further refined” Proposed Final Judgment expected in November 2024, followed by a Revised Proposed Final Judgment in March 2025. Then the hearing won’t take place until April of next year, with a ruling in August, which Google plans to appeal. | DOJ Filing, The Keyword Blog, Adweek

Ad Economy

Last month we highlighted the partnership between the Interactive Advertising Bureau (IAB) and the Media Rating Council (MRC) to form an Attention Task Force, aimed at standardizing the methodologies and metrics used to measure attention. Despite this push, the industry remains divided. A 2023 eMarketer survey revealed that 47% of advertisers planned to spend more time evaluating the utility of attention metrics, despite the challenges and limited empirical evidence supporting their value.

A major new study conducted by Kroger Precision Marketing and the Advertising Research Foundation (ARF) found that attention metrics have little to no direct correlation with sales or brand outcomes. Speaking at Advertising Week New York, Kroger’s VP, Cara Pratt, referred to attention as “just a more modern vanity metric.” Notably, the ARF’s multi-year project echoes these results, revealing that various attention measures, whether through eye tracking or facial coding, demonstrated little to no correlation with brand success metrics. Even the most complex attention measures, such as DoubleVerify’s Authentic Attention, showed minimal impact on driving sales, despite being accredited by the Media Rating Council.

As the advertising landscape continues to fragment, the emergence of new, engagement-focused metrics will be critical. However, advertisers should approach novel metrics with caution, especially when they are presented as decision-making tools for media buying. | eMarketer, AdAge

Consumer Economy

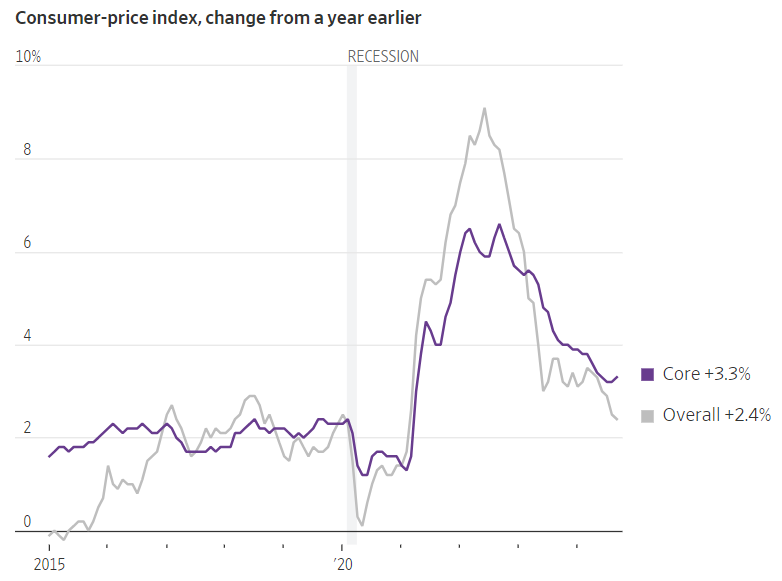

1. Fresh CPI numbers were published last week, revealing a mixed picture on inflation, with headline CPI continuing to decline, but “core” CPI ticking upward. Core CPI excludes the volatile food and energy categories, and is generally regarded as more reflective of secular trends in the price level. The headline figure of 2.4% is the lowest reading since March 2021, which was the month when inflation began its dizzying upward spiral, eventually peaking at 9% in June of 2022.

The question in everyone’s mind is how this reading will impact the Fed’s interest rate decision; the next meeting of the Fed’s Open Market Committee is November 6th – 7th, right after Election Day. Most analysts had been expecting a quarter-point reduction in rates following the half-point reduction in September, but this inflation reading, coupled with a very strong recent jobs report (see next story), clouds the picture somewhat. | WSJ, Bloomberg

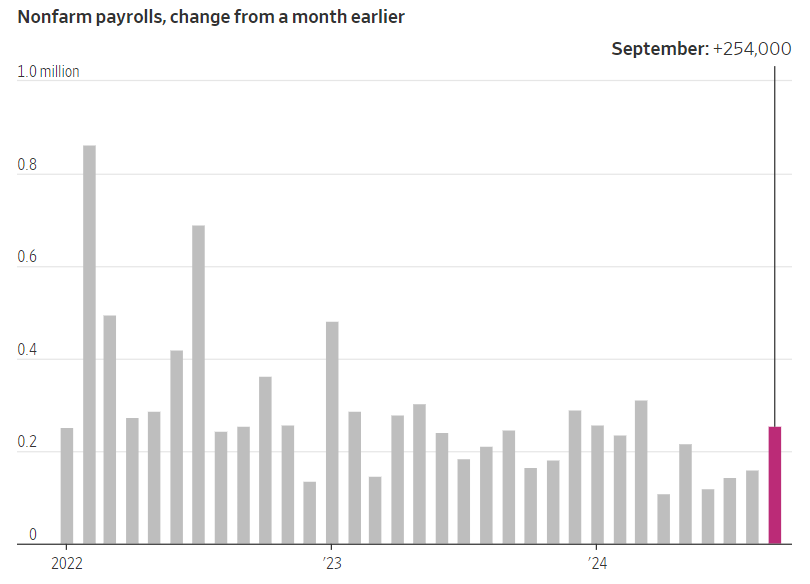

2. The first week of this month brought a fresh jobs report, which showed job growth accelerating in September and surpassing all forecasts with 254k net jobs added. We should note that several recent jobs reports have been subsequently revised downward, and it’s possible September’s figure will be trimmed somewhat as well. Sectors leading the way in job growth were bars & restaurants, construction, and the less cyclical healthcare, education, and government.

There will be another jobs report released on November 1st, before the Fed’s next interest-rate setting meetings; however most observers feel the September jobs figures effectively rule out another half-point reduction, making a quarter-point cut the more likely outcome. | WSJ, Bloomberg

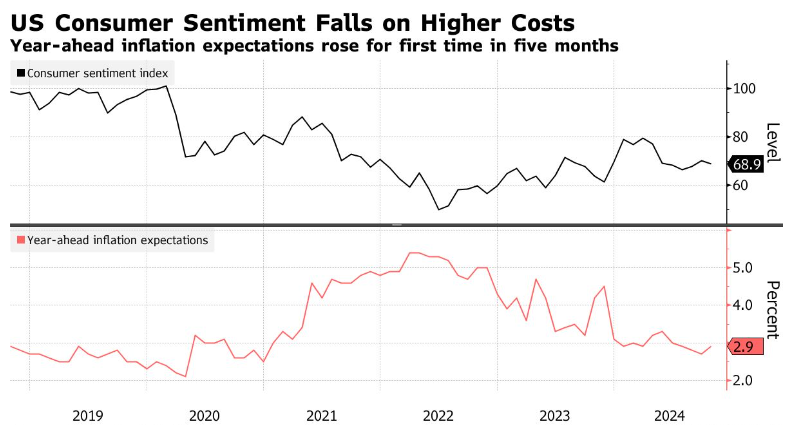

3. Despite falling inflation and the rosy employment picture, consumer sentiment unexpectedly fell for the first time in three months, as consumers’ perception of their current financial situation dropped to the lowest level since the end of 2022.

As we’ve pointed out previously, consumer sentiment remains well below pre-pandemic levels over four years hence, despite retreating inflation and a historically strong labor market. And it seems clear from the data, namely the sharp decline in sentiment in early 2020, that it was the pandemic itself, and not the burst of inflation that began in early 2021, that was the primary factor. | Bloomberg