Key Highlights:

- TV & Audio: The leadership change in Washington is unlikely to simplify the nation’s complex web of privacy & data laws, though it may open the door to streaming consolidation.

- Paid Social: Reports suggest that ads on Threads could be coming in early 2025, but Meta leadership remains officially non-commital for the time being.

- Display & Programmatic: Creators are becoming more influential in the consumer journey.

- Search: Alphabet’s stock saw gains following the US presidential elections, with experts predicting a lower likelihood of a Google breakup under Trump.

- Ad Economy: The UK CMA isn’t finished with Google yet & the (not so) surprising rise of AppLovin.

- Consumer Economy: Inflation ticked up a bit in October, and the political tribes are hot-swapping their views on the state of the economy.

TV & Audio

Unlike four years prior, audiences found out the results of the 2024 presidential election rather quickly, with major networks calling the race for former (now incoming) President Trump in the early hours of Wednesday morning. This may have had an impact on audience sizes; while news viewership jumped year-over-year, election night audiences were down significantly from 2016 and 2020 figures across cable and broadcast networks, with the lowest percentage of households tuned in on TV in more than half a century. With streaming taking a bigger piece of the live sports pie and major news events struggling to make up the difference, the question remains: how much longer can linear TV remain a premier entertainment channel?

1. It has only been a matter of days since the presidential election, but as we know, the advertising industry – and TV in particular – moves near the speed of light. As such, it’s worth taking stock of what the second Trump administration might mean for advertisers looking to leverage TV and audio content in their campaigns, as well as for the digital advertising landscape writ large.

Data privacy has been a major topic in the space over the last few years, and we’re likely to continue to see a fragmented privacy approach from the government going forward. Currently, online privacy laws are unevenly applied nationwide, with some states like California using strict legislation to protect users’ personal information and others like Mississippi having limited regulation. These laws are highly relevant to the application of digital marketing, including CTV, as they directly affect both the ability to measure performance through user matching and the ability to target audiences through first and third party data. There were pushes earlier this year to pass the American Privacy Rights Act, a bipartisan bill that would have unified the privacy framework nationwide, forced more data transparency from platforms, and given users the ability to opt out of targeted advertising and delete their data. It is unclear whether the Trump administration would support a national privacy law, but given privacy-limiting actions in his prior term, it may be a while longer before a national framework is established.

Beyond privacy, there is also the question of industry consolidation, a topic we’ve often alluded to given the fragmented streaming landscape. Under Lina Khan’s FTC, tech companies have faced higher regulatory and antitrust pressure, but expectations are that the Trump administration will curb the FTC’s efforts, which may make the path to streaming consolidation more straightforward. More broadly, the return of the Trump administration signals a broader shift in audience interest towards new media platforms; Trump notably appeared on The Joe Rogan Experience during the campaign, vice president Harris appeared on Call Her Daddy, and the Harris campaign explicitly targeted streaming & digital video environments with major investments on YouTube, Hulu, Peacock, and more.

As we saw above, traditional linear TV is in a state of secular decline that even major political events cannot abate, and both sides of the aisle have recognized that fact.

While there are still lots of outstanding questions for the new administration (and two more months of the current administration), advertisers should be prepared for a landscape with ongoing – and perhaps increased – privacy fragmentation, accelerated publisher consolidation, and further audience shifts towards new, digital platforms like streaming and digital audio. | Osano, WSJ, eMarketer

2. As cord cutting pressures continue to mount, Comcast is considering a spinoff for its cable networks, which include properties such as MSNBC, Oxygen, Syfy, and Bravo. The new entity would remain owned by Comcast, but would free up the main company to focus on a digital future and could also give the company a means to acquire other distressed cable assets. Meanwhile, the company is exploring combinations for Peacock after already launching a partnership with Paramount for the SkyShowtime platform in Europe. While specific partnerships for Peacock have yet to be announced, it does seem a logical next step for the platform, as it struggles to keep up with the Google / Netflix / Amazon / Disney stranglehold on domestic viewership.

Three years ago, Comcast reportedly explored an acquisition of Roku; while those considerations ultimately failed to materialize, that kind of deal – or even just a partnership with another FAST property – could be reexplored in the near future. Advertisers should keep an eye on these developments, as growing partnerships and combinations could be the catalyst for streaming CPMs to begin to rise again after meaningful reductions in recent years. | Nielsen

Paid Social

Since launching Threads, Meta has faced ongoing speculation about when it will begin monetizing the platform by enabling ads. Initially, the company indicated it would delay ads until the new platform reached a billion users. However, with 275 million active users and a report suggesting ads could appear on Threads by early next year, it seems Meta might be reevaluating its timeline. The company’s recent statements are non-committal, reaffirming that ads aren’t imminent, yet not entirely ruling out the possibility.

This cautious stance aligns with Meta’s statements in its latest earnings call, where CFO Susan Li emphasized that Threads is not expected to drive significant revenue in 2025, with a focus on enhancing user experience and engagement first. For now, this suggests Meta is prioritizing growth and community-building on Threads, likely delaying any ad placements to avoid disrupting the user experience or causing backlash as the platform finds its footing.

For advertisers, this means Threads remains ad-free for the time being, allowing brands to continue observing user engagement trends and prepare for potential future opportunities. Should Threads continue on its growth trajectory, a more structured ad rollout could come sooner than later. But with Meta’s current focus on solidifying user value, it’s likely that significant ad integration on Threads won’t happen until the platform reaches higher user milestones and has a clearer direction. | SocialMediaToday, SocialMediaToday, The Information

Display & Programmatic

Creator earnings will soar in 2025. That is one of the main takeaways from EMARKETER’s Future of Digital 2025 report released last week, estimating that creator earnings will climb to $16B in 2025, up 16% YoY. This growth underscores creators’ growing influence on consumer purchasing decisions across various digital platforms.

The consumer journey has become heavily influenced by creators, particularly on YouTube, where 87% of consumers say they get the highest quality product information on the platform. Harvard Business Review’s study of the creator economy further quantifies this influence, estimating that if each creator can influence $10 worth of spending among just 1% of their followers per year, the total impact on consumer purchases could reach $130 billion—likely a conservative estimate of creators’ power.

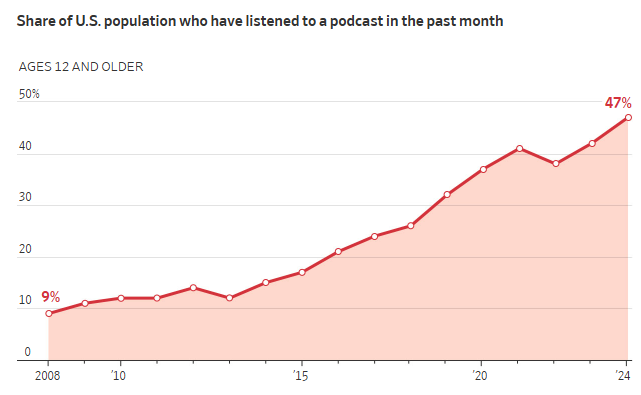

The influence of creators isn’t confined to traditional social media platforms. EMARKETER forecasts podcast creator revenues will nearly triple by 2025, reaching nearly $1 billion. The TV and streaming sector is also experiencing creator-driven growth. Alphabet’s recent earnings report revealed a 30% increase in the number of creators earning the majority of their YouTube revenue through TV screens, demonstrating the increasing influence of creators across multiple formats.

Given that viewers are turning to creators as their primary source of entertainment, particularly on the TV screen, YouTube is rolling out a new feature that allows creators to organize their content into episodes and seasons. This new feature will make it simpler for viewers to dive into and binge-watch their favorite creator content, creating a more seamless and engaging viewing experience.

As creators continue shaping consumer behavior and entertainment, brands must build comprehensive influencer and creator strategies that span all channels. By doing so, they can better engage with consumers throughout their decision-making process, ensuring they remain relevant and visible. | EMARKETER, HBR, Think With Google, The Verge

Search

Immediately following last week’s re-election of former President Trump, Alphabet’s stock rose. This was in part due to speculation about potential shifts in antitrust policies that would come with a changing of hands in the White House, particularly concerning the ongoing cases against Google’s dominance in online search. Some believe the expected changes to Trump’s incoming DOJ could bode well for Alphabet (Google’s parent company), with experts wondering if the new DOJ would be more open to a settlement.

In October, Trump expressed reluctance about a potential Google breakup, saying, “If you do that, are you going to destroy the company? What you can do without breaking it up is make sure it’s more fair.” According to Brian Pitz, a BMO Capital Markets analyst, “While Google’s antitrust cases likely continue for the foreseeable future, a breakup is less likely, with rising potential for a ‘slap on the hand fine,’ similar to Microsoft in 2002.” However, Trump is not expected to drastically curtail antitrust enforcement, according to Reuters. The DOJ is expected to submit its more detailed proposed remedies later this month, after which time Google will have the opportunity to respond, with further court proceedings anticipated in the first half of 2025. | Investors.com, The New York Times, Reuters

Ad Economy

1. We’ve previously told you about the UK’s Competition & Markets Authority (CMA) raising serious concerns regarding Google’s plans to deprecate 3rd party cookies in Chrome. We also told you about Google’s change of tack, announcing it would not be deprecating 3P cookies after all, instead favoring a solution that will empower users to make their own decision regarding their opt in/out status. We had noted in our analysis that the issue would likely come down to how exactly the consent mechanism would be implemented. Now, the next chapter in this David vs. Goliath saga is upon us in the form of the November 2024 CMA Privacy Sandbox Report.

The CMA has formally acknowledged Google’s revised cookie consent model, which now enables users to actively opt in or out of data sharing. Despite this step toward user empowerment, the November 2024 report raises continuing concerns about Google’s Privacy Sandbox. The CMA highlights that Google’s framework could reinforce its market position by limiting alternative data-sharing methods where 3rd party cookies are unavailable. These unresolved concerns suggest that balancing user privacy with fair competition remains a core challenge for regulators and the ad tech industry; indeed, as we’ve told you in the past, these two priorities are in insoluble tension.

For marketers, the shift raises questions about how targeting precision and campaign optimization may be impacted within Chrome, where Privacy Sandbox is likely to limit access to 3rd party data alternatives. | UK CMA 2024 Report

2. AppLovin, a name for a business that one may assume is an homage to the 2007 teen comedy Superbad, has been in the headlines this week on the back of its miraculous stock performance. AppLovin’s recent market gains have propelled its market cap above The Trade Desk, making it a pivotal moment for advertisers to reassess this platform’s potential. Self-described as an alternative to search and social, AppLovin’s programmatic mobile app advertising platform stands out by owning both the buy and sell sides of the business.

The company’s 2022 acquisition of MoPub from Twitter exemplifies the power of vertical integration in ad tech, combining demand-side (DSP) and supply-side (SSP) platforms. This consolidation has enabled AppLovin to leverage cross-platform insights from a wealth of bidding and performance data, allowing advertisers to maximize ad efficiency in ways few competitors can replicate. In a recent discussion between industry experts Eric Seufert and Ben Thompson, it was highlighted how AppLovin’s dual-control setup creates an ecosystem similar to Google’s. This structure allows for seamless optimization across its ad inventory, positioning the company for further revenue growth and competitive advantage.

For advertisers, AppLovin may well present a novel opportunity for brands that have reached a point of diminishing returns within Search & Social mediums. It is unlikely to be a universally performant medium for all verticals, but with an upcoming focus on Ecommerce, we suggest watching them closely as a potential medium for expansion. | TechCrunch, Stratechery

Consumer Economy

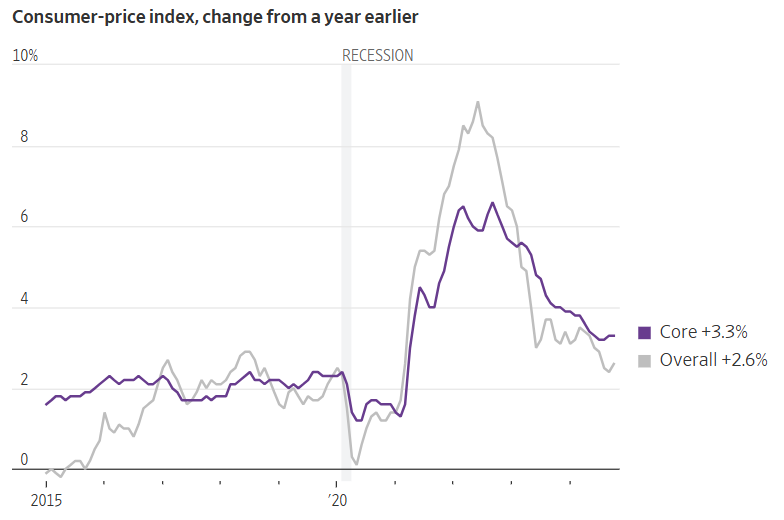

1. The major macroeconomic news of the week is a fresh inflation print, which showed CPI inflation increasing to 2.6% YoY for October, up from September’s 2.4%. September’s figure was the lowest reading of the CPI since February 2021, the month before the post-pandemic inflation spurt took off.

This latest inflation reading comes a week after the Fed cut its benchmark interest rate by a quarter-point, its second rate reduction in two months. This latest inflation reading, alongside a minor civil proceeding last week, creates some uncertainty around what most analysts have expected to be a consistent path of rate cutting. Many economists expect inflationary policies from the new administration; to the extent the Fed shares these expectations, it may choose to keep monetary policy somewhat tighter than otherwise. And a higher inflation reading would also argue for a pause in rate reductions. Still, financial markets are pricing in an ~80% chance of another rate reduction next month. | WSJ, Bloomberg

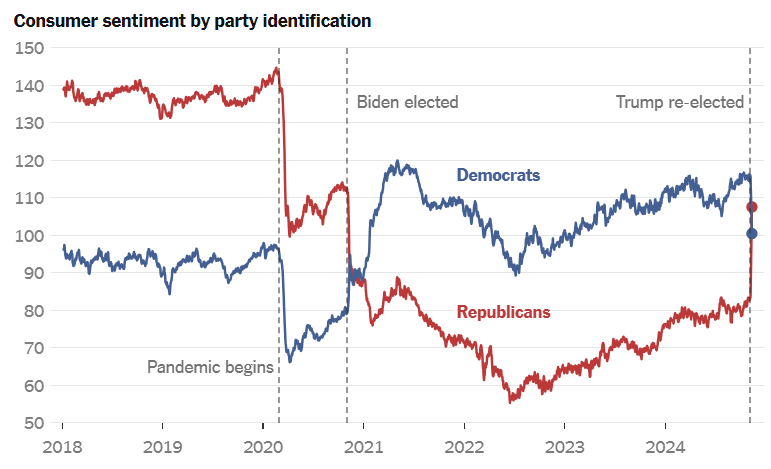

2. MOTIVATED REASONING WARNING: We’ve given you frequent updates on consumer sentiment as a barometer of the general health of the economy (see here, here, here), but we’ve never parsed that data by political affiliation. As you may be aware, there was a slightly contentious election last week, and it’s a good time to remind ourselves that consumers’ perceptions of the economy are heavily influenced by political views. Behold:

It would seem that we can draw three firm conclusions here:

- As we’ve noted before, consumer sentiment is well below pre-pandemic levels. While Democrats are (for the moment) a bit rosier than pre-2020, Republicans are much more bearish. On net, this is highly consistent with our picture of a significant decline in sentiment on a population basis.

- Consumers of both parties can agree on at least two things: pandemics are bad, and excess inflation is bad.

- The economy is much better when my team is in charge.

To the extent that your customer base is meaningfully left- or right-coded, do be aware that there is a pretty violent swing underway right now in the relative degree of economic optimism within those groups. Those on the political right will probably be in a more spendy mood this holiday season, while those on the left may be in a more parsimonious mood. | NYT