This article has been submitted by Exness.

While currency and crypto markets are typing to find new narratives, there’s one market that is on the rise in February: the Chinese stock market. The Hang Seng index had grown for almost 10% for the last two weeks, fueled by the release of a new AI model called Deepseek – a direct competitor of OpenAI and ChatGPT.

In this review, we will try to figure out whether this rally has a chance to continue or not.

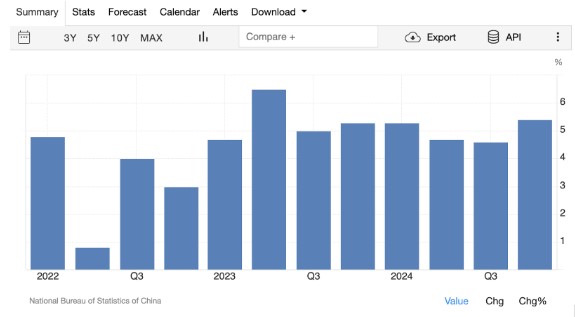

According to the National Bureau of Statistics of China, the Chinese economy expanded by 5.4% year-over-year in the fourth quarter of 2024, up from 4.6% in the previous quarter and exceeding market expectations of 5.0%. This marks the strongest annual growth rate in 18 months, driven by a series of stimulus measures introduced since September aimed at stabilizing the recovery and restoring investor confidence.

Industrial production saw a notable acceleration in December, reaching an eight-month high, while retail sales rebounded after a three-month slowdown. However, despite these positive indicators, the unemployment rate climbed to a three-month peak, highlighting persistent challenges in the labor market.

China GDP Annual Growth Rate. Source: https://tradingeconomics.com/china/gdp-growth-annual

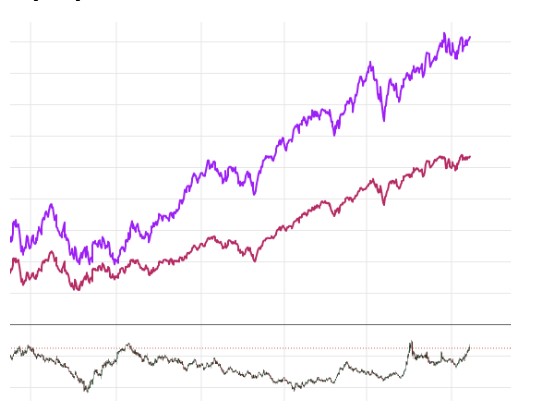

Despite the local strength, Hang Seng index (gray) was uncorrelated with S&P 500 (purple) and Nasdaq (red) indices. Now we observe the long awaited rotation between US indices and Hang Seng.

Comparison between Hang Seng, S&P 500 and Nasdaq stock indices. Source: Tradingview.com

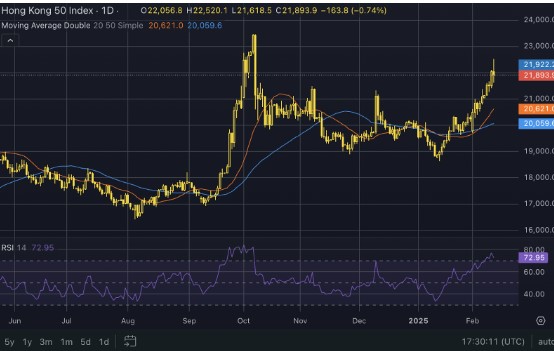

From a technical point of view, the index had reached the overbought territory, showing some signs of profit-taking, based on the 14-day Relative Strength Index. After a two-week rally, it’s possible to observe some consolidation or a correction. The AI-driven rally can be volatile and unpredictable. For example, early this month, investors have observed a big drop in NVDA and other chipmaker stocks. Alibaba had trimmed gains after Apple had announced some AI features in China.

Given the fact that competition in this field is extremely tight, it’s possible to see an extended profit-taking for BABA, BIDU, Tencent and other related stocks.

Relative Strength index (14) points to an overheated market condition for Hang Seng index. Source: Exness.com

BABA

Alibaba stock price was moving in a sharp rally within the last two weeks period, having reached the psychological level of $117 and a strong resistance area. If this level holds, it’s possible to witness a wide “cup-and-handle” pattern, which might serve as a trigger to an intermediate-term reversal. Otherwise, price may plummet following profit-taking that might follow

BIDU

Despite the strong driving narrative, BIDU had displayed less prominent growth than BABA, and had reached the upper border of Bollinger bands indicator with a parameter of 50. This usually might indicate an excess, and lead to a mean-reversion move back to the middle of the range.

Conversely, it might be a decent point for a breakout if the positive sentiment for Chinese stocks will prevail, but this is a less dominant scenario.