Key Highlights

- TV & Audio: Adalytics rocked the ad world with a scathing report on industry brand safety, leading to backlash against monitoring tools like DoubleVerify and IAS.

- Display & Programmatic: Digital gaming has gone mainstream, with smartphones and connected TVs bringing more diverse audiences into the fold.

- Search: YouTube is being increasingly cited in Google’s AI Overview search results.

- Ad Economy: Chrome plans its launch of Global Cookie Choice Prompt following an initial test in the EU.

- Consumer Economy: A cooling labor market and a hot inflation report limit the Fed’s scope for more accommodative monetary policy.

TV & Audio

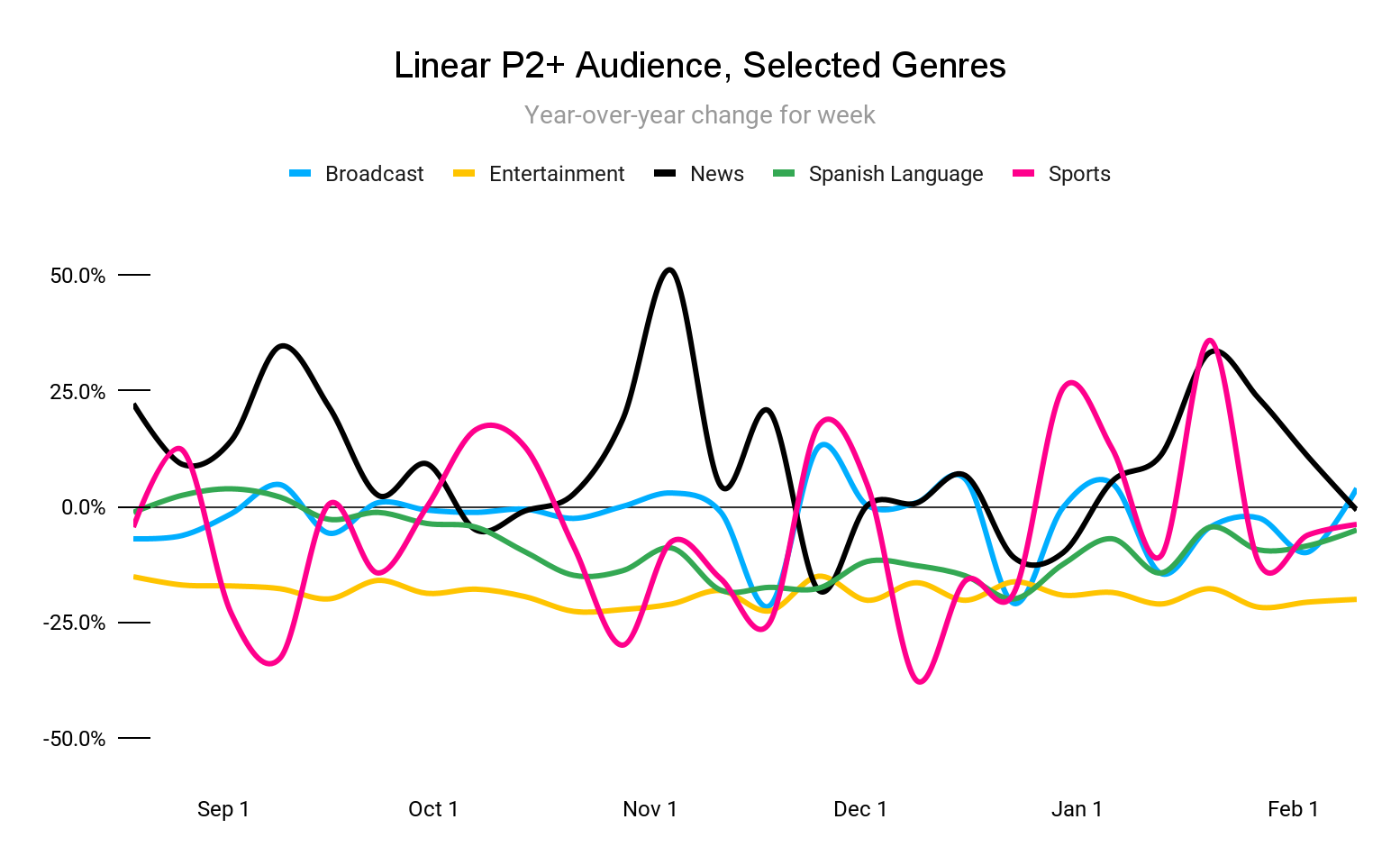

Despite a record-breaking Super Bowl audience on February 9th, overall linear viewership remains generally flat year-over-year across broadcast and news inventory, while entertainment viewership remains consistently down by ~20% as cord cutting continues.

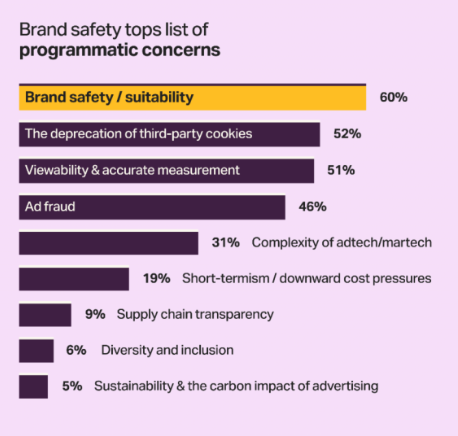

1. The digital marketing world was rocked two weeks ago when Adalytics, an ad quality and transparency platform known for its industry research, released a scathing brand safety report alleging that a slew of advertisers, including many major brands, had inadvertently served ads against highly illicit content. The report is linked here, and reader discretion is strongly advised due to the upsetting content. Per the report, many brands – including household names like MasterCard, Starbucks, Amazon Prime, Clorox, Honda, and even the Department of Homeland Security – had served ads to two domains featuring illicit user-generated content through common programmatic tools; in many cases, these ads were served with reputable brand safety monitoring tools such as DoubleVerify (DV) and Integral Ad Science (IAS) applied. The revelations led to an outcry in the industry, culminating in a probe launched by a bipartisan group of US Senators.

The report was released into an environment where video marketing is becoming increasingly programmatic, leading to a great deal of concern from advertisers and agencies alike on how to best protect brands from appearing against salacious content. DoubleVerify and IAS received much of the heat from this report, and in response both companies released statements promising to make improvements. DoubleVerify noted it “is conducting an additional comprehensive review of ad-supported image hosting sites on the open web and… defining a mechanism to block anonymous, profile-based image-hosting sites at scale.” IAS similarly “initiated a review of the sites in question and other similar domains, and… will take the learnings from this review into account as [they] re-asses [their] classifications for image-hosting sites on the open web.” DV also rolled out new tools for added protection, including a new “Highly Illicit: Do Not Monetize” category and a “P2P Sharing & Streaming” avoidance category.

While we are encouraged by the immediate steps DV and IAS have taken, Tinuiti is also making its own preparations in regard to this report. Once the report was released, we moved to place the offending sites on agency exclusion lists across the board, and we have also begun developing an agency inclusion list (that is, a small set of individually pre-approved sites) for use on programmatic campaigns with the highest brand safety needs. We will be releasing this inclusion list in the coming weeks. Advertisers should be clear-eyed that open web advertising necessarily invites some level of risk; pre-bid brand safety tools like those from DV and IAS can be useful but also clearly are imperfect. While the terrible outcomes highlighted by Adalytics are edge cases, the risk is still non-zero, and particularly brand safety-conscious advertisers in online video may consider a combination of 1) inclusion-list based advertising, 2) curated content from specific publishers (for instance, OTT Advisors), or 3) increased investment in affordable CTV content, such as that from FAST networks like Tubi and Roku. We are confident that we are taking appropriate steps to protect our clients, and we encourage any concerned advertisers to speak directly to their teams on additional actions they can take. | Advanced Television

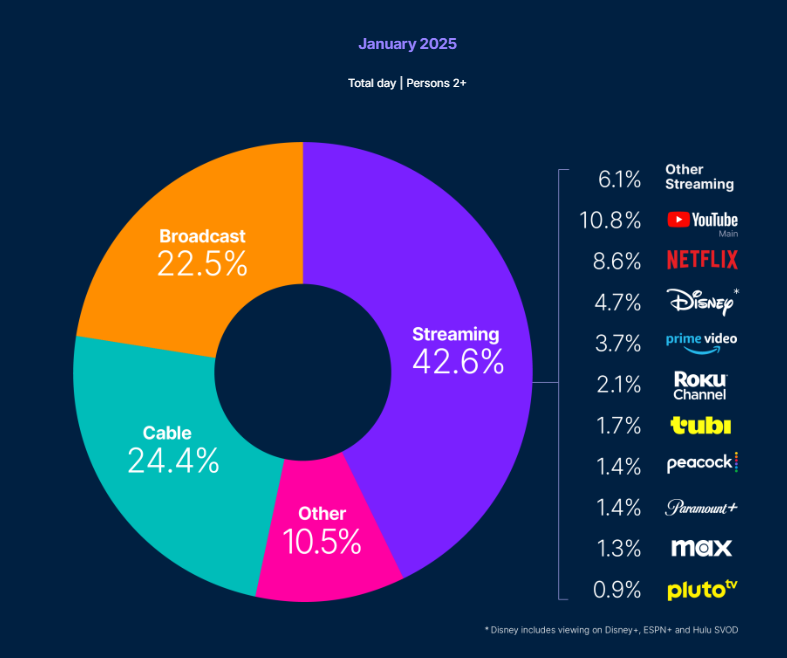

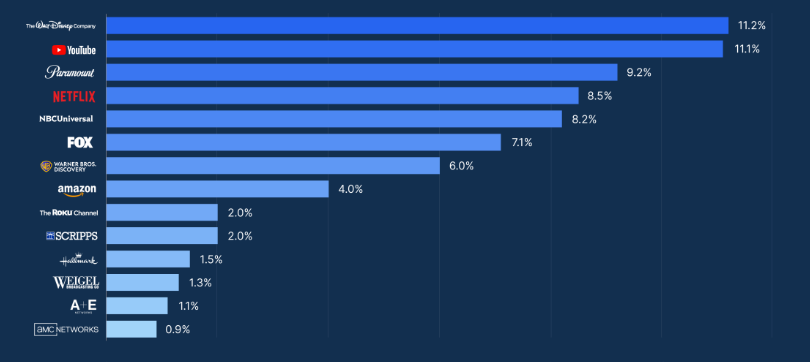

2. We’ve often discussed the fragmentation of the streaming landscape in this forum, mostly from the perspective of audiences splitting their time between different publishers – NBCUniversal, Amazon, Paramount, Netflix, etc. However, the publishers themselves have fragmentation as well; think Fox, whose viewers split between Fox Sports streaming and Tubi, or Paramount split between Paramount+ and Pluto. Perhaps the canonical example was Disney, owner of major platforms like Disney+, Hulu, and ESPN. These internal divisions are often legacies of M&A or ad hoc streaming growth, and they don’t necessarily improve the viewing experience. To that end, Disney announced this month that it will begin consolidating its streaming offerings within its flagship Disney+ platform.

The move includes new live sports programming exclusive to Disney+, as well as the addition of Hulu & ESPN content into Disney+. Disney CFO Hugh Johnston remarked, “Disney+ just continues to be a stronger and stronger service. The bundle with Hulu is working quite well… Consumers are looking at it and saying ‘this is a platform we need to have in our household.’ It’s kind of a must-have service.” That sentiment has been borne out in viewership trends; starting with its most recent release, Nielsen’s Gauge has begun consolidating all Disney streaming properties into a single line-item, making Disney the third largest streamer (behind YouTube and Netflix) with it remaining the largest individual distributor of TV across all platforms (including linear).

We have long suspected that the streaming landscape is likely to coalesce, both within and across publishers, to maximize both audience capture and advertising revenue. This announcement from Disney is another example of this ongoing trend. With nine streaming properties sitting at over 1% in Nielsen’s Gauge, expect further consolidation ahead. | Nielsen

Display & Programmatic

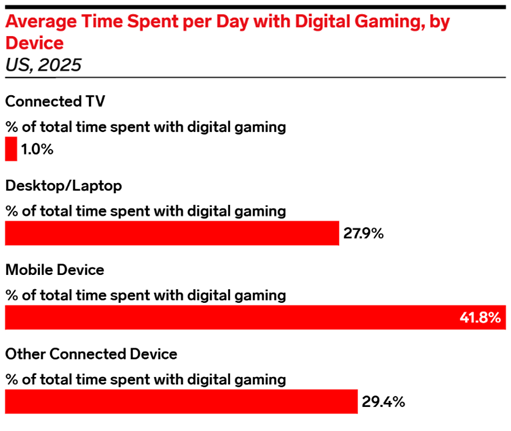

Digital gaming is thriving, with a more diverse audience than ever. According to a recent eMarketer report, over 200 million Americans—more than half the U.S. population—are digital gamers. Once limited to consoles like the Sega Genesis and PlayStation (oh, the nostalgia!), gaming has evolved, with smartphones now accounting for 40% of gaming time.

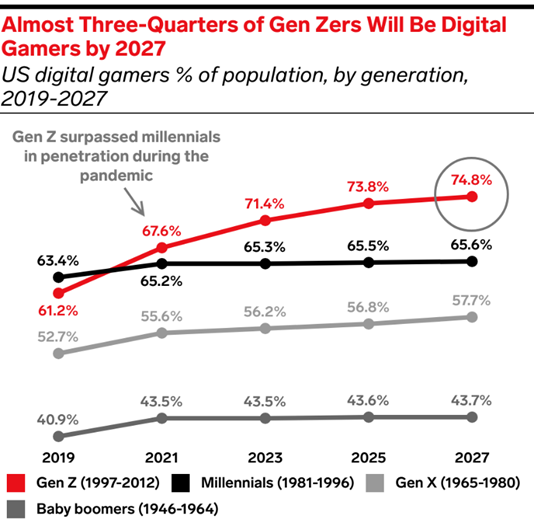

This shift has broadened the gaming demographic. While Gen Z leads with a 70% adoption rate, the average gamer age has risen to 36 as millennials continue gaming into adulthood, and gaming among those 50+ grows, particularly in social media and mobile app games.

Beyond mobile, gaming on connected TVs is a trend we expect to gain traction. Netflix, for instance, has been leaning into gaming for some time, focusing on narrative-driven games based on popular shows like Emily in Paris and Squid Game to create a connection between streaming content and interactive mobile experiences. Now, it’s looking to expand its efforts – subscribers can play Netflix games on their TV if the connected TV has the Netflix app and their account is in the beta. In its latest earnings call, the company also announced plans to introduce party and couch co-op games on TV in an effort to reimagine family board game nights and classic TV game shows.

Despite the industry’s rapid growth, digital gaming remains an underutilized advertising channel. Brands have a unique opportunity to engage a diverse and often hard-to-reach audience. The key to success, however, requires an audience-focused approach.

Millennials, for example, are highly receptive to in-game commerce, with 82% saying brand partnerships with games enhance their perception of a brand. With their preference for action/adventure games, developing exciting in-game experiences can create an immediate and lasting impact.

Gen Z, on the other hand, sees gaming as a social experience, often using platforms like Discord for collaborative play. While Discord has traditionally avoided advertising, it has gradually begun rolling out ad products and focusing on ad revenue growth. This should unlock new brand opportunities to engage individual gamers and gaming communities.

As gaming expands, brands embracing this evolving space with an audience-led approach can build meaningful connections with consumers in new and interactive ways. | eMarketer, The Verge

Search

A recent BrightEdge study reports that Google’s AI Overviews (“AIOs”) are integrating more and more video content from YouTube to supplement AI-generated answers, citing 36% MoM growth as of Feb. 8, 2025. This is particularly common for “how to” type searches that show step-by-step video tutorials, with nearly 60% of citations for videos involving instructions or demonstrations. It’s also common during the research stage of a consumer journey, with AIOs including YouTube videos that show product comparisons and real-world examples.

This trend suggests that Google’s AI is leaning heavily on YouTube content as an information source. While product pages tell users about a product, videos can more quickly answer questions that would take long paragraphs of text to explain. Google AIOs are also extracting technical specifications from product videos, and showing timestamped video segments to supplement answers.

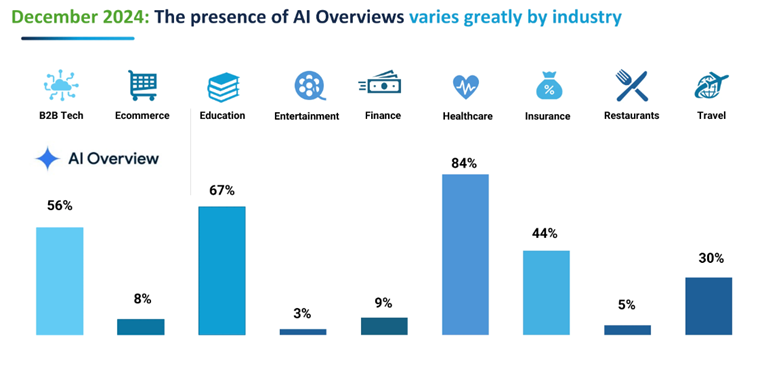

Based on December 2024 BrightEdge data, the presence of AIOs in general continues to vary by industry. AIOs seem to appear more frequently in industries like healthcare and B2B tech where search queries tend to be more informational in nature.

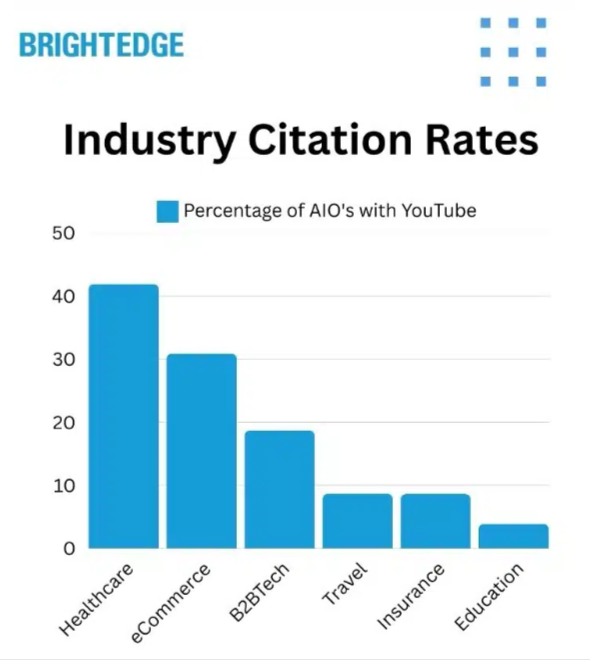

Relatedly, this newer BrightEdge report shows that AIOs that include YouTube citations are more common in certain industries than others, with the heaviest prevalence skewing toward Healthcare (~42%) and eComm (31%).

It’s no surprise that Google’s AI generated search results are becoming increasingly visual, since the entire Google SERP has followed that same trend for years. This reinforces the importance for marketers to take a holistic approach to their content strategy. Aligning organic YouTube and traditional SEO strategies can help improve chances of being cited in AIOs. | Search Engine Land, BrightEdge

Ad Economy

In the never-ending saga that is the perpetual stay of 3P cookie execution within Chrome, Google is now rolling out its Cookie Choice Prompt globally after an initial test in the EU. This prompt gives users the option to reject third-party cookies, a move that aligns with regulatory expectations but raises questions about its real-world impact on ad effectiveness. Google claims it is committed to user privacy while maintaining an ad-supported web, yet the execution of this initiative is under scrutiny.

A key concern is whether Google’s Privacy Sandbox can truly replace third-party cookies as a viable ad targeting mechanism. A recent report from Google prepared for the UK’s Competition and Markets Authority (CMA) reveals that Privacy Sandbox is not yet delivering results comparable to cookies, with many advertisers experiencing performance drops of 60-100%. In fact, even Google has admitted that its Privacy Sandbox is still a work in progress.

Meanwhile, critics argue that Google’s control over both Chrome and the ad ecosystem allows it to dictate privacy policies in ways that ultimately favor its own business. The Movement for an Open Web (MOW) suggests, as if to echo the tone of AdTech twitter, that these changes could further entrench Google’s dominance by making it harder for competitors to run effective ad campaigns.

Marketers and publishers are left in limbo as they navigate this transition. With Google’s phaseout of third-party cookies still scheduled for 2025, brands should continue testing alternative solutions, including first-party data strategies, contextual targeting, and identity solutions like UID 2.0. However, as we have previously concluded following all prior announcements, given the ongoing struggles of Privacy Sandbox, ad buyers should remain skeptical and closely monitor performance shifts as Google’s changes unfold. | AdsExchanger, UK Govt, MOW

Consumer Economy

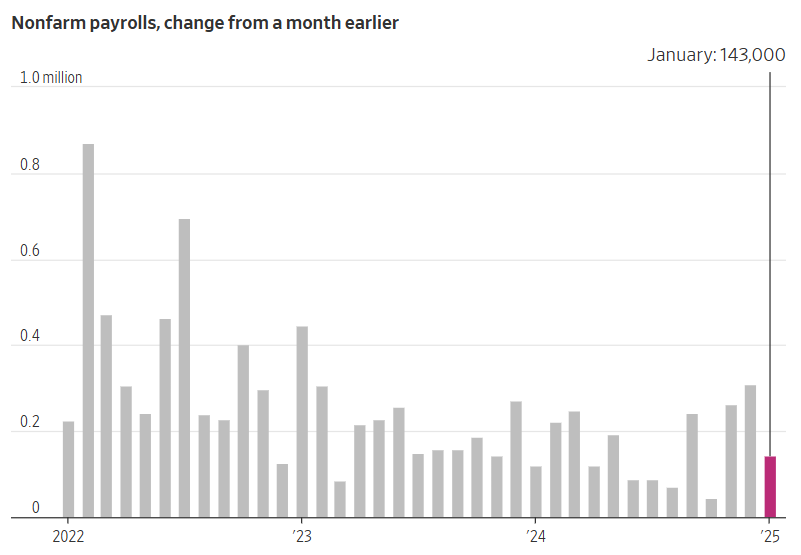

1. While we are certainly not venturing any predictions about the macroeconomy, storm clouds appear to be gathering. The second week of February brought the latest jobs report, which showed a solid, if unspectacular, gain of 143k jobs in January. This brought the official unemployment rate down to 4.0%, and the jobs figures for November and December were revised upward.

The picture above is of a labor market that is cooling, but still healthy. The clouds lie somewhat deeper in the data, which one prominent macroeconomist summarized as follows: “Today’s jobs report provides more evidence for the view that inflation remains a very significant problem. Average hourly earnings rose by 0.5%, well above the 0.3% rate consistent with the Fed’s inflation target.” The basic idea being conveyed here is that price inflation is downstream of wage inflation; wage inflation has been ~4.6% over the past six months, which is far above the 3% – 3.5% that is consistent with the Fed’s target of 2% price inflation. What’s worse is that wage inflation has accelerated in the past six months, undermining the view that the inflation situation is increasingly under control.

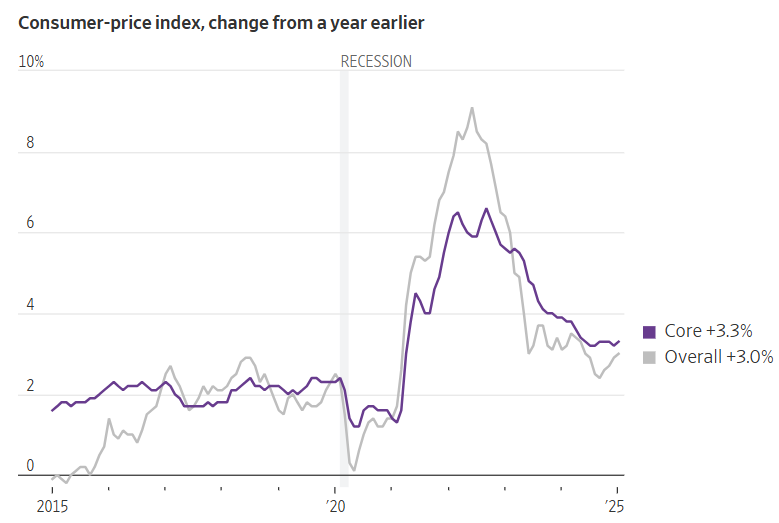

Right on cue, a fresh inflation print was released the following week and it showed core consumer prices rose 3.3% YoY; the monthly increase of 0.5% was the largest since August 2023.

January is a single data point, and one should be very cautious in interpreting modest movements in high-frequency data. But it almost certainly takes a Fed rate cut off the table in the near term, to which markets reacted swiftly, hitting equities and raising bond yields. Following the release of the report, Fed Chair Powell said at a Congressional hearing, “We are close, but not there on inflation … So we want to keep policy restrictive for now.” | WSJ, EconLog, WSJ, Bloomberg

2. Right on cue, consumers are getting grumpier. Consumer sentiment fell about 5% in preliminary February figures, reaching its lowest reading since July 2024. Expectations of inflation in the year ahead jumped from 3.3% in January to 4.3%, the second month in a row of large increases and the highest reading since November 2023. According to the survey results, tariff threats, stock market swings, and rapidly reversing executive orders are causing Americans across the political spectrum to feel considerably more pessimistic about the economy than they did before the new administration took office.

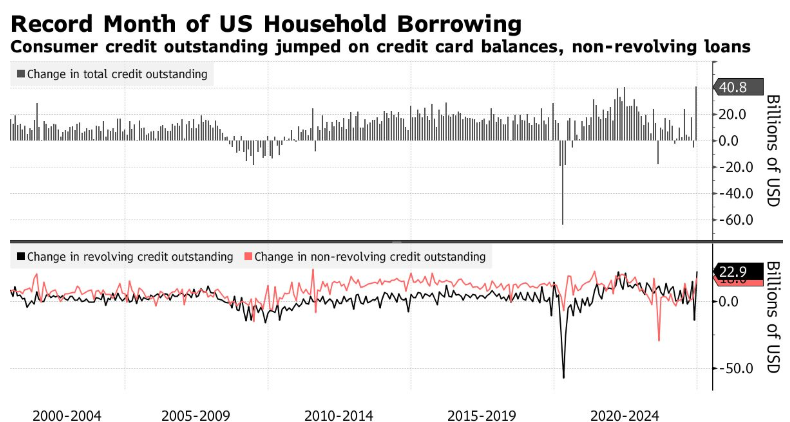

Deteriorating sentiment is already manifesting in spending and borrowing behaviors. McDonald’s reported that its low-income customers’ purchases from the chain were down substantially in Q4, reflecting increased financial pressures on this segment; the company noted that this appears to be an industry-wide phenomenon, indicative of wider trends in the economy. At the same time, outstanding US consumer debt unexpectedly surged by the most on record in December, reflecting large increases in credit-card balances and non-revolving credit.

The combination of general consumer pessimism, persistently above-target inflation, increasing consumer indebtedness, and a cooling labor market make for a complex near-term macroeconomic picture. | WSJ, Bloomberg, Bloomberg