When the world’s largest risk assessment company says that climate change is a huge risk for the insurance industry, even legislators need to listen.

Blackrock is the world’s largest risk assessment company, whose 19,000 employees directly manage US$9.42 trillion in assets. When it comments, global capitalism listens.

And what Blackrock said about climate change was shocking to companies that had not kept up with the news.

Its study found that 95% of global insurers believe that climate risk is an investment risk.

This is coming up as an open wound in Florida right now, where homeowners are struggling to pay soaring home insurance premiums. Florida’s ill fortune has been caused by several factors, including fraud and excessive litigation, but the main driver is climate change. It drives extreme weather events that have been responsible for major damage.

Climate-driven insurance claims in the state, which eat into companies’ profits, has led many companies to leave the state the past years. In addition to those which have left the state completely, other companies have cut coverage in some parts of the state.

Many homeowners have been driven out of the private sector market completely.

Citizens Property Insurance Corporation is a non-profit organization that provides property insurance protection to people who would normally be entitled to obtain coverage through the private market but are unable to do so. It is known as the state’s insurer of last resort. State regulations limit how much Citizens’ rates can rise, because the insurer is backed financially by the state.

If a particularly destructive event such as a major hurricane were to occur, there is a chance that Citizens’ budget would not be enough to cover the losses, and the costs would become the burden of the government of Florida.

As private companies flee, Citizens has experience massive growth, from 443,229 policies in late 2020 to more than double that amount – 1, 211,914 policies – in 2024. Citizens grew over 65% in a single year as more and more Florida homeowners found themselves unable to buy policies elsewhere.

Right now one of its top priorities is ‘depopulation’, by which it means shedding 500,000 of its policy-holders to find coverage in the private market. In other words, it wants to get a lot of people off its raft.

Fox School of Business professor Benjamin Collier at Temple University in Philadelphia pointed to the coming hurricane season as a major concern: “”Forecasters predicted that this will be an especially strong hurricane season, and record-breaking Beryl suggests that they’re right.” Another major hurricane, he notes, could “wipe out some of the small insurers in the state. The hurricane season in Florida lasts through November.

“The small insurers often cater to lower-income homeowners. If an insurer goes insolvent, the state has a fund that will play claims to its policyholders. But getting a claim paid through this state fund can take a long time, months or even years.”

In the last seven years Florida has weathered five major hurricanes. Michael, which made landfall in 2018 in the Panhandle, was the first category 5 hurricane to strike the continental United States since Andrew in 1992. Ian, in 2022, was the costliest hurricane in state history and third-costliest on record nationwide, after Katrina in 2005 and Harvey in 2017. Recent major Florida hurricanes also include Irma in 2017, Nicole in 2022, and Idalia in 2023.

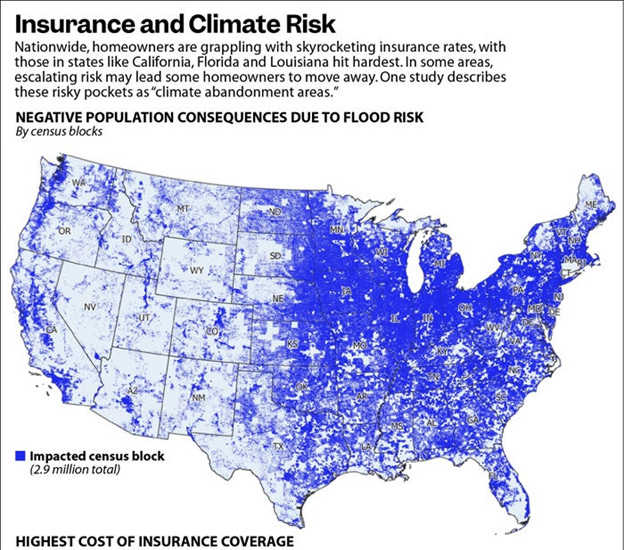

Across the country, homeowners are grappling with skyrocketing insurance rates and dropped policies, with those in California, Florida, and Louisiana hit hardest.

Some 39 million homes and businesses are vulnerable to flooding, hurricanes, and wildfires whose risk has not been priced into their policies, according to a study by the First Street Foundation. These vulnerable but unprotected places can be called an “insurance bubble” of overvalued properties. They need to be downward-adjusted to take in the new higher insurance rates.

Rates that are driven by climate change.

Escalating risk may lead some homeowners to abandon certain areas. Even in some of the fastest-growing metropolitan areas, like Miami-Dade County, properties lost as much as $3.99 per square foot in home value due to flood risk. This has led to “climate abandonment areas,” where population declines can be linked with climate vulnerability.

Floridians know it’s going to flood. It’s just a matter of time. And if they can’t insure against it, they leave.

And these days, there’s no denying that this horrific prospect is due to the impact of human activities on climate change.

Rising temperatures due to carbon dioxide emissions are triggering wild extremes. The rising temperatures are warming the oceans, shrinking the ice sheets, melting the glaciers, destroying the snow cover, raising the sea level, adding to air pollution and health problems, increasing the number of extreme weather events, and increasing the acidity of the surface ocean water.

The fact that corporations (read: profits) are behind the disintegration, can be demonstrated by the amount of money they are pouring into the effort to deny their involvement:

A graphic by Brown University scientist Bob Brulle showing the $8.2 BILLION in anonymous money going into climate denial and obstruction.

Republican state officers are using regulatory tools and the public pulpit to pressure banks and large investors into ignoring climate change’s impacts on their finances, the economy, and the planet.

Their cause is hopeless; you wonder why they carry on, for such (relatively) trivial gains in comparison to the costs. It reminds me of the days when tobacco companies pushed back against the cancer warnings. The industry made less than a $1-billion/year, against the ‘opportunity cost’ of abolishing tobacco, and obtaining a net benefit of $4-billlion from the savings in human life.

Estimates are that the world GDP would be 37 per cent higher today had no global warming occurred over the past 30 years.

But if one is going to treat the economy as a private-sector money box, then no long-term benefits are going to be considered.

While billionaires are building climate-proof castles, the rest of us are dealing with a litany of their second-hand climate crime:

· The highest heat index ever recorded ( heat index is what the temperature feels like), 82.2C (180F) was registered in southern Iran on August 28, 2024;

· The planet as a whole is heating up at the rate of more than a dozen Hiroshima atom bombs going off every second of every minute of every day…about a million bombs a day in new energy;

· The hottest month ever recorded globally occurred this year (June, 2024);

· The hottest day every recorded was July 21st, 2024, with an average global temperature of 17C (63F). “We are now in truly uncharted territory and as the climate keeps warming, we are bound to see new records being broken in future months and years,” said Carlo Buontempo, the director of the Copernicus Climate Change Service; and

· The world economy is already committed to an income reduction of 19% until 2050 due to climate change – damages that are six times larger than the mitigation costs needed to limit global warming to two degrees.

Climate change can be reversed; this is not hopeless. Remember the hole in the ozone layer, that was threatening human health? Every UN member state adopted the Montreal protocol in 1987 to reduce the release of ozone-depleting substances into the atmosphere – and it worked!

Humans can make the big changes.

But not if they are solely motivated by profit. They need national rules so they everyone acts in everyone’s interests.

This is the bind that Florida is in today.

In many ways, it is not the fault of the insurance companies that they have decided to pull out of the state. They are just following their actuarial tables.

Something new is needed to motivate change, not reaction.

In the largest investment in climate resilience in the history of the Commerce Department, VP Harris proposes to invest $575 million in projects to help coastal communities adapt to climate change. The proposal, which would fall under the National Oceanic and Atmospheric Administration (NOAA)’s Climate-Ready Coasts initiative, would fund 19 projects along the seaboard and Great Lakes regions.

Trump calls climate change a hoax…even as the water levels rise near his house in Mar a Lago.

In 2023, a year that was characterized by historic extreme heat across much of the country, the US experienced a record 28 disasters that each caused more than the $1 billion in damage. The data show a clear upward trend in the number of severe events each year.

One factor in the rise of damage claims is that people want to live on the coast. Eighty percent of Florida’s population lives in coastal communities.

They are experiencing climate effects far worse than the fact that their coral reefs are bleaching in the crazy heat of the oceans today. They are getting lacerated by a series of storms that get a power boost from climate change.

The latest storm, hurricane Debbie, gives an example of what a relatively mild event can do: it killed six people, drenched the area with up to 30 inches of rain, toppled trees and damaged property.

The privately insured losses from Hurricane Debby will amount to approximately $1.4 billion, according to its high-resolution reference model used by Karen Clark & Company. That includes $845 million from wind damage, $130 million from storm surge, and $440 million from inland flooding.

Debbie was the second hurricane of the 2024 season.

Far worse was Hurricane Beryl, in June. It was a Category 5 hurricane (Debbie was Category 1) that was an early season, record-breaking storm that made three landfalls. It was the longest-lived June storm on record, supercharged by very high ocean temperatures. It’s as if the Atlantic was running a fever.

In fact, those Atlantic ocean temperatures are triggering a warning to us: something is seriously wrong. Beryl was the earliest Atlantic storm on record. It also formed furthest east over the ocean than any other. These are not good records…these are grim tidings.

Hurricanes are also becoming stronger faster, a phenomenon known as rapid intensification. In fact, several recent storms have gone from tropical storm to major hurricane overnight —something that used to be a rare occurrence. Scientists have found that climate change is leading to more favorable conditions for hurricanes to strengthen more quickly, such as warmer waters.

Together, nation-wide, Debbie and Beryl caused at least 94 fatalities and at least $8.915 billion in damages.

Florida property owners already pay more than four times the national average for home insurance. America’s average rate of $2,377 is far below the average rate of $10,996 paid by Florida homeowners. The most expensive insurance in America is found in Hialeah, south Florida, where the average premium is $17,606.

That average Florida rate is expected to jump another 7% this year to $11,759.

Can private insurers cover this?

“No company in the world has enough cash to cover Florida storms,” said Michael Mailliard, owner of MIC Insurance. “In 2021, just two out of the 40 (insurance) companies made a dollar. Thirty-eight out of 40 companies took money out of assets to stay afloat.”

Six of the 10 most expensive cities in the U.S. for homeowners insurance are in Florida.

Sixty percent of Florida homeowners don’t carry separate flood insurance. This at a time when climate change means that storms now move slower, have more threatening storm surges, and bring increased rainfall.

More than a dozen Florida home insurance companies have declared insolvency since 2019. Farmers Insurance stopped covering Florida and major insurers have not renewed policies for high-risk homes.

Twenty-one percent of homeowners say they can’t afford their current mortgage rate for long, and 9 percent say they can’t afford it now. Rising insurance costs add to the burden of home purchase, and drive away many people who had otherwise planned to retire in the state.

The rapid intensification of hurricanes will continue in the future unless drastic measures are taken to limit further climate change.

At what point does the struggle of the private sector insurance companies get overwhelmed by the problem inflicted by all of society: climate change?

Florida is one of the top greenhouse gas-emitting U.S. states. It has the main motivation and the main ingredient needed to stop the climb of insurance rates: desperation, and cause.

Florida can lead the way to take immediate actions to reduce our emissions of greenhouse gases in order to slow down and limit warming.

Right now, it is in a state of Republican denial. That may not last much longer; money is a wonderful motivator.

However, their Republican governor has solved the climate change problem; he has removed mentions of climate change from state law.

“The legislation I signed today [will] keep windmills off our beaches, gas in our tanks, and China out of our state,” Ron De Santis announced, listing the three things that are the real problems Floridians need to address.

Don’t look up. So simple.

Never mind that health-care costs due to fossil fuel pollution and climate change already exceed $800 billion a year.

We’ll see who will win, ultimately. A politician who is denying the reality of a crushing climate change that could cost Americans born in 2024 nearly $500,000, due to higher taxes and pricier housing and food, or a governor who won’t come in out of the rain.

The younger people know which way to go. A number of colleges are now offering a new major: climate change studies. Schools that offer such majors are reporting a big increase in demand.

De Santis, in the meantime, is busy taking books off the college shelves. You never know what kind of bizarre theories the kids will learn.

I used to have a place near Venice, Florida. It is near the State College of Florida. The town and university are ten feet above sea level.

That’s a number that boggles my mind. High tide where I live now is over 50 feet. Never mind the storm surges.

When the floods come, homeowners and college students can read De Santis’ regulations to the rising surf: “You do not exist”.

Maybe the water will retreat.

It’s happened once before, in a far-away land, a long time ago.

Somehow, I don’t think De Santis has that kind of drag.

Florida could otherwise take the lead in climate change, and be an action hero for America. It could lower its insurance costs and stop billions of dollars in damage.

That would require public sector leadership.

Place your bets.

To help do something about the climate change and global warming emergency, click here.

Sign up for our free Global Warming Blog by clicking here. (In your email, you will receive critical news, research, and the warning signs for the next global warming disaster.)

To share this blog post: Go to the Share button to the left below.