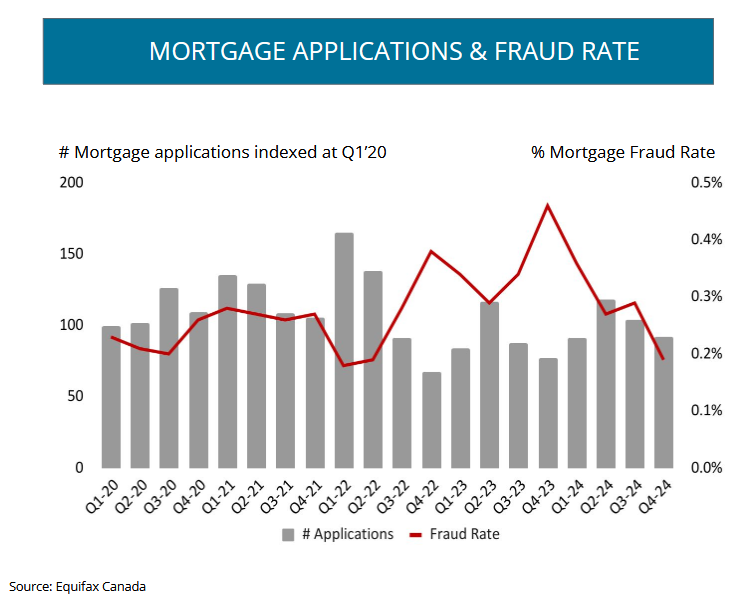

Mortgage fraud falling overall, but rising among first-time buyers

According to Equifax Canada’s latest Market Pulse Report, the national mortgage fraud rate dropped to 0.2% in Q4 2024—a level not seen since Q2 2022. “The mortgage fraud rate has remained relatively low, with application fraud significantly down by 37.6%,” said Cherolle Prince, Director of Fraud Consulting at Equifax Canada. Despite the overall decline, Alberta, […]

Singh pledges low-interest, government-backed mortgages for first-time homebuyers

On a campaign stop in Port Moody, B.C., this weekend, Singh unveiled a plan to offer low-interest, fixed-term mortgages directly backed by the federal government. The program would be available to first-time buyers and, according to Singh, could save borrowers “tens of thousands of dollars” in interest payments. For example, a reduction of just 0.5% […]

Exclusive: TD levels the playing field with real-time pricing for brokers

Speaking at a conference this week, TD’s Devon Ajram, Vice President of Broker Services, announced that real-time pricing will go live in the broker channel on Tuesday. TD’s real-time pricing—already available to its Mobile Mortgage Specialist (MMS) team since October—will now be extended to the broker channel, putting brokers on equal footing with TD’s other […]

Deed tax increase won’t hurt demand for Nova Scotia recreational properties: Realtor

By Keith Doucette In an interview Friday, Matt Honsberger, president of the Halifax office of Royal LePage Atlantic, said he’s optimistic about the recreational real estate market because most waterfront properties in Atlantic Canada, which can sell for under $500,000, are significantly cheaper than in other parts of the country. As an example, Honsberger said […]

Strong GDP growth in January may be short-lived as tariff threats loom

Real GDP rose 0.4% in January, building on a 0.3% gain in December and slightly surpassing both Statistics Canada’s flash estimate and economists’ expectations. The growth was broad-based, with 13 of 20 industries posting gains. Goods-producing sectors led the way with a 1.1% increase—their strongest monthly performance since October 2021—driven by mining, utilities, manufacturing, and […]

BMO tightens mortgage rules for steel and aluminum workers, but experts urge perspective

Though experts say the policy change shouldn’t come as a surprise, and likely won’t affect a significant proportion of borrowers, the heightened restrictions on tariff-hit industries signal a troubling economic trend. Citing the tariffs and a “turbulent economic landscape,” BMO BrokerEdge released a memo to broker partners announcing that steel and aluminum are now part […]

Montreal archdiocese launches real estate arm aimed at maximizing social impact

By Sidhartha Banerjee and Morgan Lowrie The creation of the Roman Catholic Real Estate Corp. of Montreal, announced Thursday, is the first non-profit subsidiary created by a Catholic archdiocese “to leverage real estate development as a tool for community benefit” and heritage preservation, the church says in a news release. With congregations dwindling and buildings […]

Why Scotiabank thinks the Bank of Canada is done cutting rates

While most of Canada’s Big 6 banks expect at least one more rate cut from the Bank of Canada this year, Scotiabank believes the central bank is already finished. In its latest forecast, Scotia sees the BoC’s overnight rate holding at 2.75% through 2026—well above the 2.00% predicted by BMO and National Bank, and the […]

EV-ready parking spots should be required in new apartment builds: report

By Jordan Omstead As Canada sets out on major home-building plans, the federal government and most provinces have no regulations to ensure those apartments are EV ready, the Clean Energy Canada report said. Apartment-dwelling is more prevalent among younger Canadians, who are also generally more inclined to go electric, the report said. “In short, those […]

Bank of Canada’s urge to cut rates fades amid tariff uncertainty

Officials acknowledged Canada’s economy had ended 2024 on a strong note, with robust growth of 2.6% and inflation near the 2% target, supported by previous rate cuts. However, the outlook for early 2025 weakened considerably due to increased caution among consumers and businesses. Surveys have indicated a significant pullback in spending and investments due to […]