Try our free mortgage calculator now!

Using mortgage calculators can be very useful in the early stages of planning, but one should know that these tools have limitations. Let’s look at some of them: Mortgage calculators are trustworthy tools for estimates, but they’re not a substitute for formal loan disclosures or a full pre-approval process. As a mortgage broker, you can […]

Reverse mortgage explained: How it works and who qualifies

a line of credit fixed monthly payments combination of both options While they are widely available, HECMs are offered solely through FHA-approved mortgage lenders. 2. Proprietary reverse mortgage This type of reverse mortgage is not federally insured. If your clients’ property has high value, they can get a bigger loan advance […]

One in three Europeans ready to quit over U.S.-style work trends

Another 83% also said they are worried that high-profile leaders under the Trump administration, such as Elon Musk, will have a negative influence on workplace culture in their country. Leaving U.S. corporate culture In the wake of the growing influence of U.S. work styles, 34% of employees said they would walk away from their current […]

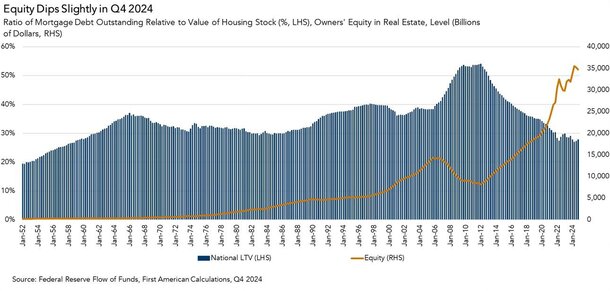

Here’s Why the Housing Market Isn’t Crashing Today

With home prices out of reach for many today, an obvious question has been when will the housing market crash? To be honest, this question gets asked pretty much every year, and it is a certain cohort of the population that always seems to want it to happen. I get it – homeownership should be […]

Court lets lender undo mortgage discharge years after foreclosure error

That discharge became the focal point of the current litigation. EMC contended the discharge had been sent in error, noting that its established policy prohibited issuing discharges after third-party foreclosure sales. Although a discharge was prepared and mailed, the note was never returned, canceled, or marked satisfied. A company executive later attested that the discharge […]

Mortgage forbearance improves, but FHA borrowers still fall behind

The policy allowed FHA to front payments on behalf of distressed borrowers, but critics now argue that it’s propping up unsustainable loans and delaying the return of needed housing inventory to the market. Read more: MBA urges FHA to tweak “complex” payment supplement partial claim rule Of the 52,531 FHA loans that went seriously delinquent […]

Flagstar Bank loses $256k lien in DC condo foreclosure, court rules

More than two years later, in January 2017, Flagstar filed a judicial foreclosure suit. It later amended its complaint to argue that the 2014 foreclosure was unconscionable and legally invalid, and added new claims for declaratory relief, breach of fiduciary duty, and unjust enrichment. The trial court dismissed all claims, holding that the prior foreclosure […]

Housing coalition presses Congress to act on trigger lead reform

Read more: Mortgage trigger lead reform bill gets second chance in Congress The coalition also emphasized that the burden of opting out falls entirely on the borrower, who must notify the CRA and wait five business days for the opt-out to take effect, which then lasts for five years. During that window, borrower data remains […]

10-year Treasury yield rises as Trump renews attacks on Powell

In the wake of Trump’s remarks, broader markets reacted sharply. US stocks experienced sell-offs, while the dollar surged to its highest level in three years. Gold, traditionally viewed as a safe-haven asset, spiked to a record high above $3,400 per ounce. “President Trump’s increasingly confrontational posture against Fed chair Jerome Powell makes investors wonder if […]

Why hybrid finance firms thrive in Hawaii’s pricey market

It’s the model Reed Myers (pictured) has refined over the years. During the 2008 crash, he joined the mortgage company his father founded and eventually expanded it into a multi-branch operation. Today, Myers oversees lending, brokering, and fund management at Myers Capital and Myers Investment Group, firms that operate with a lean team but a […]